May 14, 2018

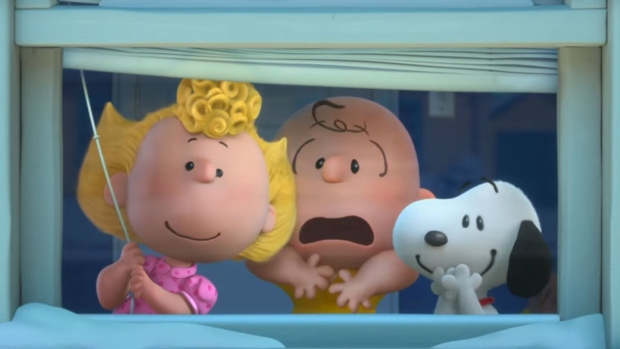

DHX selling stake in Peanuts, warns it might suspend dividend; shares fall

Shares of DHX Media fell in early trading on Monday after the company said it was parting ways with a significant stake in the Peanuts franchise in a bid for some balance sheet relief, while warning it might pull the plug on its dividend.

The Halifax-based children's entertainment powerhouse announced on Monday it will receive $237 million from Sony Music Entertainment Japan in exchange for a 39 per cent ownership stake in Peanuts Holdings, the company behind Snoopy and Charlie Brown. After the deal closes, DHX will still own 41 per cent of the iconic franchise, with the remaining 20 per cent held by Charles Schulz's family.

"This transaction will allow DHX Media to de-lever our balance sheet as we team up with an ideal partner to help us reach our worldwide growth targets for Peanuts in the coming years," said DHX Media CEO Michael Donovan in a release.

DHX closed its purchase of an 80 per cent stake in Peanuts, alongside full ownership of Strawberry Shortcake, last June. It paid US$345 million for the assets, and funded the purchase in part with a new borrowing agreement comprised of a US$30 million revolver and US$495 senior secured loan facility.

DHX shares have been in steady decline since late September, with shares down 40.9 per cent as of the close of trading on Friday.

The company launched a review of strategic alternatives in October. On Monday, it said it will no longer provide financial forecasts amid uncertainty about the outcome of licensing opportunities that are currently being negotiated.

DHX also warned on Monday it is considering de-listing from the Nasdaq and suspending its two-cent per share dividend to save costs.