Jul 7, 2021

Didi extends slump as China weighs changes to U.S. IPO rules

, Bloomberg News

China Is Concerned of Cross-Border Data Transfer: Zhang

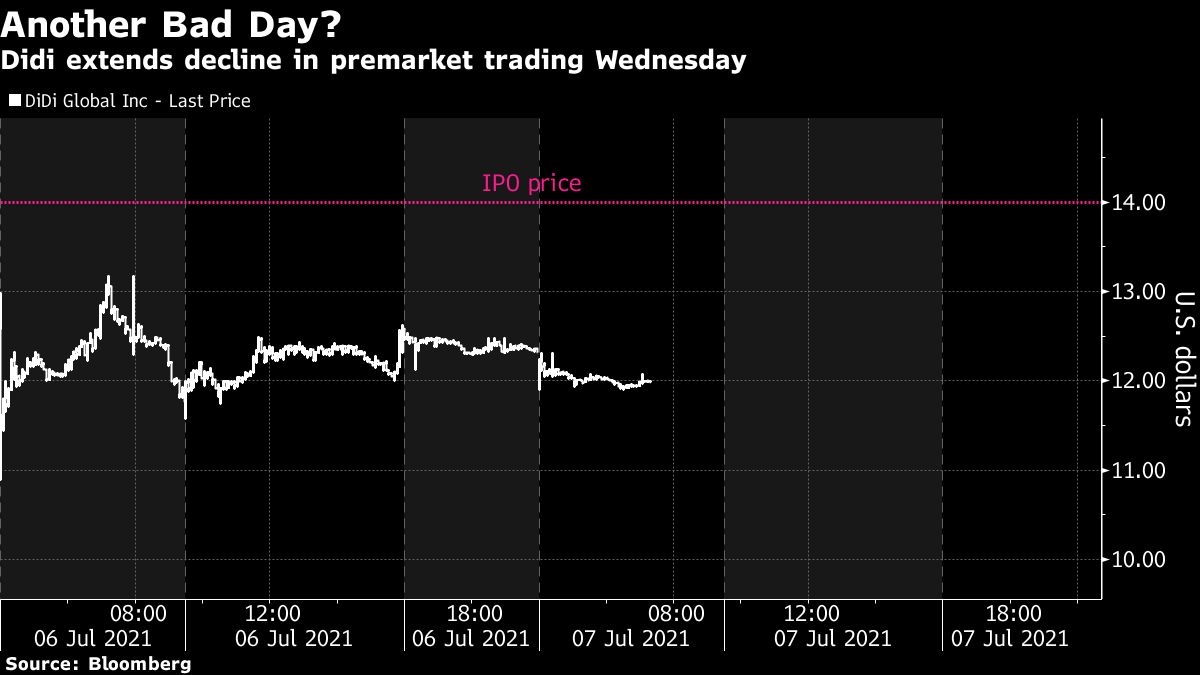

Didi Global Inc. extended losses in U.S. premarket trading, falling further from the price the shares were sold at in last week’s initial public offering, as China was said to consider closing a loophole used by firms listing their shares abroad.

The ride-hailing company traded at US$11.96 as of 7:34 a.m. in New York, after falling as low as US$11.90. The American depositary shares slumped 20 per cent to US$12.49 in Tuesday’s session, having been sold at US$14 in the IPO.

Regulators in Beijing are planning rule changes that would allow them to block a Chinese company from listing overseas even if the unit selling shares is incorporated outside China, shutting off a route long-used by the country’s technology giants, according to people familiar with the matter.

The China Securities Regulatory Commission is leading efforts to revise rules on overseas listings that have been in effect since 1994, said the people, asking not to be identified discussing a private matter.Read more: China Mulls Closing Loophole Used by Tech Giants for U.S. IPOs

China on Tuesday issued a sweeping warning to some of its biggest companies, vowing to tighten oversight of data security and overseas listings. That put further selling pressure on China’s biggest technology names including Alibaba Group Holding Ltd., JD.Com Inc. and Baidu Inc. The shares gained slightly in premarket trading Wednesday.

A gauge of Chinese technology stocks traded in Hong Kong fell as much as 1.9 per cent on Wednesday to approach its lowest level since November. The index has slumped more than 30 per cent since its February high, while a measure of Chinese American depositary receipts tumbled 3 per cent on Tuesday.

Didi’s offering was the second-largest U.S. IPO for a Chinese firm on record. The company lost about US$15 billion of market value on Tuesday alone.