Oct 12, 2022

Diesel Markets Are Spiking and It’s Not Even Winter Yet

, Bloomberg News

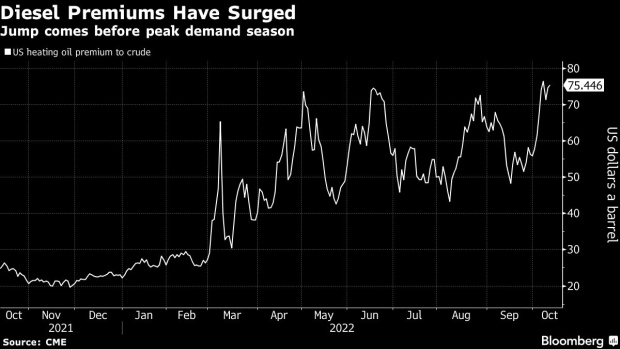

(Bloomberg) -- Diesel prices are soaring in Europe and the US, spurring a fresh bout of inflationary pressure ahead of a winter that is expected to see major supply disruption.

Europe’s benchmark diesel price neared the equivalent of $180 a barrel earlier this week. In the US, prices in California topped $190, while in New York Harbor they are close to $170.

It has been the biggest price spike in several months, foreshadowing a winter in which Europe in particular is expected to face supply turmoil as it tries to wean itself off Russian-made fuels. Industrial consumers substituting oil for natural gas -- the price of which has soared since the war in Ukraine began -- is also bullish for demand.

“The global diesel market is very strong at the moment,” said Mark Williams, research director for short term oils at WoodMackenzie Ltd. “Higher diesel prices have the potential to create even stronger inflationary pressures, especially if the current price spike is sustained, adding significant downside risk to demand and increasing the chances of a global recession.”

The latest surge in Europe has been helped by curbed supply in France, where a strike over pay at oil refineries has limited fuel supplies and forced the government to tap strategic reserves.

In the US, inventories are perilously low ahead of the winter season. It’s the same story for independent stockpiles held in Amsterdam-Rotterdam-Antwerp, northwest Europe’s oil trading hub. Consumption of heating oil -- a diesel-type fuel -- typically rises in winter.

Supply is also being hit by refineries undergoing seasonal maintenance, while some European nations are also starting to claw back the stockpiles they released to curb prices earlier in the year.

See also: France Asks Traders to Return Millions of Barrels of Diesel Soon

The high prices and low inventories are fast becoming a political flashpoint.

In recent weeks US Energy Secretary Jennifer Granholm and other administration officials chastised oil refining executives for low diesel stockpiles, floating the possibility of export limits and a requirement for companies to hold minimum inventories inside the US.

The French government is threatening to take control of some of the country’s biggest refineries that have been halted by strikes, with almost a third of the country’s fuel stations suffering supply shortfalls.

Last month, Switzerland said industrial users should burn heating oil instead of natural gas in dual-fuel power plants from Oct. 1, and that households should start filling their heating oil tanks immediately.

Approaching Winter

“We are approaching the Northern Hemisphere winter, which boosts heating oil demand,” said Jonathan Leitch, an oil analyst at Turner, Mason & Co. “There are also expectations of fuel switching, which means more diesel could be used in power generation if there is not enough natural gas available.”

With European prices soaring, refiners in Asia and the Middle East are rushing to send a flood of the fuel to Europe as France and other nations seek out alternatives. The emergence of large refined fuel export quotas in China could be set to offer some relief, after the world’s second-largest economy spent much of the year curbing its fuel exports to global markets.

Overall fuel shipments from China are expected to rise by 500,000 barrels a day to near 1.2 million barrels by year-end, according to consultant FGE. That should go some way to helping Europe plug its diesel deficit, though it’s unlikely to fully cover the supply gap.

Exports from the US have also ramped up in recent months, alleviating some of the pressure on Europe, but limiting its own build-up of inventories. Supplies on the US East Coast have been particularly constrained after several refineries in the area shut down over the past few years.

The prospect of major refineries in Africa and the Middle East starting up production could help, while sustained high prices will only boost the likely hit to global economic growth, thereby depressing demand for diesel.

For now though, the possibility of more volatility remains. Prices jumped above the equivalent of $220 a barrel shortly after Russia’s invasion of Ukraine earlier this year.

Torbjorn Tornqvist, the chief executive officer of trader Gunvor Group said at a conference last week that the European diesel market is moving toward the levels of tightness seen around the time of that surge.

Diesel is “still the tightest part of the market,” said Paul Horsnell, head of commodities research at Standard Chartered. “The main deficit in inventories is concentrated there and the main concerns about the loss of Russian material are also in the distillate space.”

©2022 Bloomberg L.P.