Jan 10, 2022

Dip buyers drive U.S. stock rebound after selloff

, Bloomberg News

We expect the volatility to increase as the market discounts more Fed hikes: BMO's Earl Davis

Stocks rebounded as dip buyers emerged to blunt a five-day selloff -- the longest losing streak since September.

After sinking 2 per cent earlier Monday, the S&P 500 almost wiped out its losses, buoyed by signs that the omicron coronavirus variant may be peaking in New York. The Nasdaq 100 turned green after the gauge of giants like Apple Inc. and Microsoft Corp. dropped as much as 8.5 per cent from its November record. Investors have been on edge as the Federal Reserve prepares to raise rates and the resurgent virus threatens economic growth.

“There are some real risks around rate hikes and whatnot, but if you look at some of the major tech companies that are falling, these companies have a massive cash moat,” Sylvia Jablonski, chief investment officer for Defiance ETFs, said on Bloomberg’s “QuickTake Stock” streaming program. “We’re in a fairly good spot, and these are great buy-on-the-dip opportunities right now.”

The Fed will likely raise rates four times this year and will start its balance-sheet runoff process in July, if not earlier, according to Goldman Sachs Group Inc. A key measure of U.S. inflation -- set to be released Wednesday -- is anticipated to have increased further in December, putting additional pressure on the central bank to tighten policy.

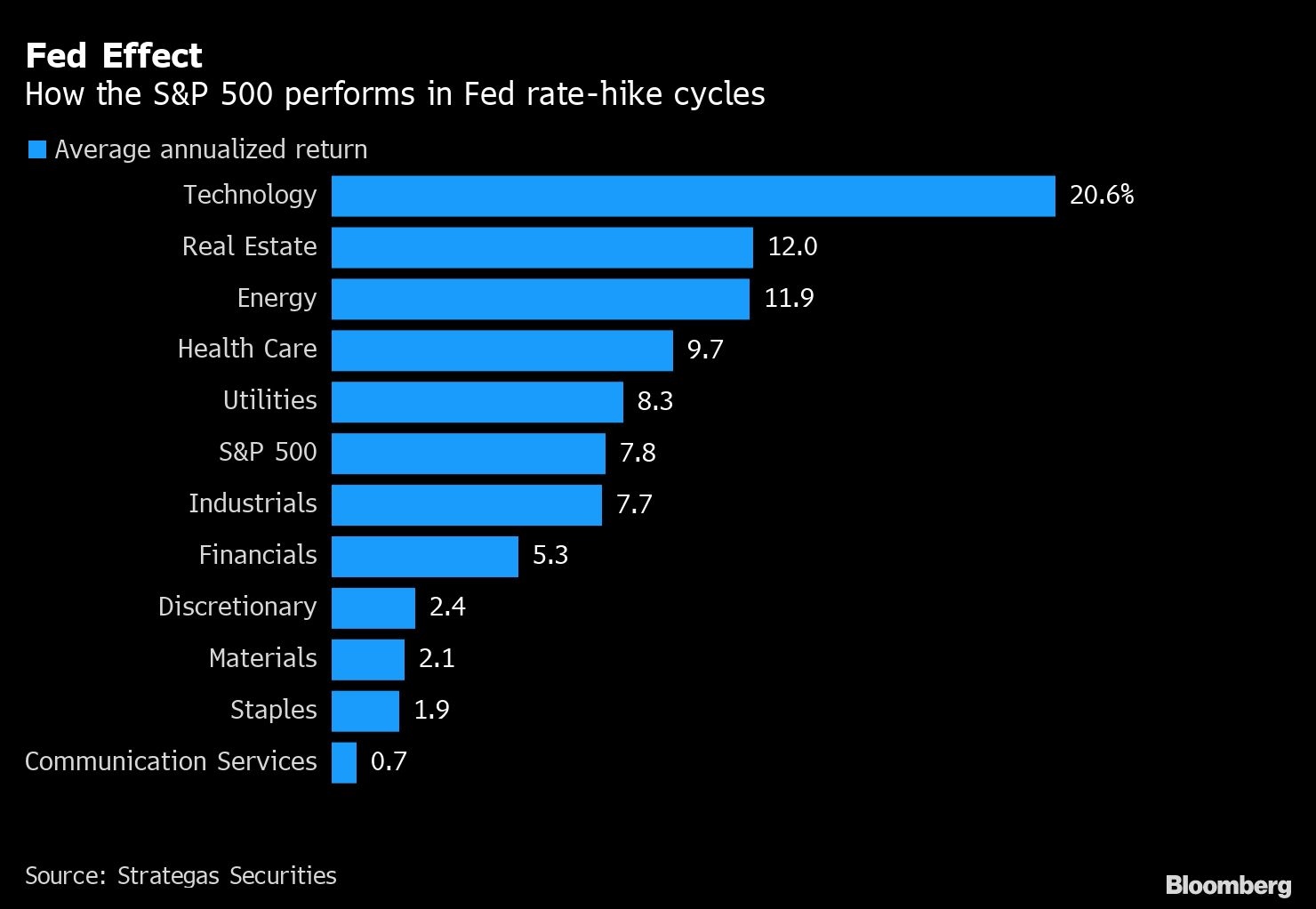

In the past three decades, there have been four distinct periods of rate-hike cycles by the Fed. On average, technology, which has been under pressure amid prospects of earlier and faster rate increases, is among the best-performing sectors during those cycles, according to Strategas Securities.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.1 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 0.1 per cent

- The Dow Jones Industrial Average fell 0.5 per cent

- The MSCI World index fell 0.3 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.1 per cent

- The euro fell 0.3 per cent to US$1.1327

- The British pound was little changed at US$1.3579

- The Japanese yen rose 0.3 per cent to 115.25 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 1.77 per cent

- Germany’s 10-year yield advanced one basis point to -0.03 per cent

- Britain’s 10-year yield advanced one basis point to 1.19 per cent

Commodities

- West Texas Intermediate crude fell 0.6 per cent to US$78.40 a barrel

- Gold futures rose 0.2 per cent to US$1,801 an ounce