Nov 5, 2021

Disappointing Q2 for Canopy amid pullback in pot sales

Canopy Growth reports disappointing Q2 results

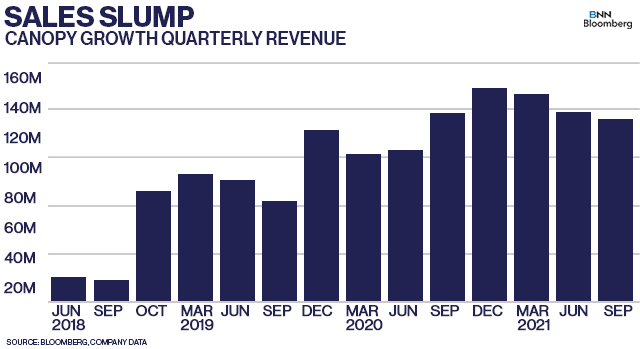

Shares of Canopy Growth Corp. moved to a fresh four-year low Friday after the company's weaker-than-expected second-quarter results following aggressive competition in the Canadian recreational cannabis space while the pot giant said its "pushing out" its target on when it expects to turn a profit.

The Smiths Falls, Ont.-based company said its second-quarter revenue fell by three per cent from a year ago to $131.4 million, while its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) swung to a loss of $162.6 million, a decline of 90 per cent from the same period a year earlier.

Analysts polled by Bloomberg expected Canopy to report $141 million in revenue in its second quarter, while also reporting an EBITDA loss of $50.1 million.

"The complicated part is that consumers and retailers are evolving quickly. So all of the change in consumer behaviour and retailer behaviour as they get more competitive with each other, it just makes it complicated," said David Klein, Canopy's chief executive officer, in an interview.

"It's a big market and it's growing and as we drive our focus on premium and mainstream as it relates to [dried] flower, we just have to navigate these areas. With new industries, when you look back on them after the fact when you say 'Oh wow, how great did that industry grow.' During the process itself, you realize it wasn't a straight line."

Much of Canopy's revenue miss was attributed to a decline in sales of its Canadian recreational and medical cannabis businesses, both of which fell four per cent in the quarter. Canopy also took an $87 million write-down on its cannabis inventory in the quarter.

Large Canadian cannabis producers like Canopy as well as its peers such as Tilray Inc. and Hexo Corp. have all suffered market share declines over the past several months due to increased competitive offerings from smaller cultivators. Those companies have tried to regain lost share by acquiring cannabis producers in certain niche categories, with Canopy recently acquiring Supreme Cannabis earlier this year to bolster its premium dried flower product selection.

The company cited an insufficient supply of dried flower with high THC levels as well as heightened competition in the value product category behind the sales drop, although it expects to "stabilize its market share" in its recreational cannabis business in the second half of its current fiscal year.

Klein said that Canopy is improving the quality of its dried flower products through new manufacturing techniques, such as hang drying and improved genetics. It’s also looking to partner with other third-party producers to offer unique, craft offerings to the market.

As a result of the sales decline, Canopy is now "pushing out" its timeline on when it expects to generate positive adjusted EBITDA, but didn't specify when it plans to achieve that milestone. Stifel Analyst Andrew Carter said in a note on Friday that withdrawing its profitability guidance "calls into question the achievability of the medium term growth outlook."

Klein declined to specify when exactly Canopy will be profitable, noting that the company needs to have revenue in the $225 million to $250 million range in order to hit that target.

"We're not saying a date, but it really is just when we kind of get the convergence of growth across our business," he said.

While its Canadian business may be under pressure, Canopy reported a 21 per cent increase in its international business to $23.6 million, mainly led by its CBD edible and vape offerings in the U.S. Its Biosteel sports drink subsidiary also reported a 47 per cent increase in sales to $7.5 million.