Dec 19, 2022

Disney closes at lowest since 2020 after tepid 'Avatar' debut

, Bloomberg News

We need proof that Iger's return to Disney will change the company's long-term trajectory: Strategist

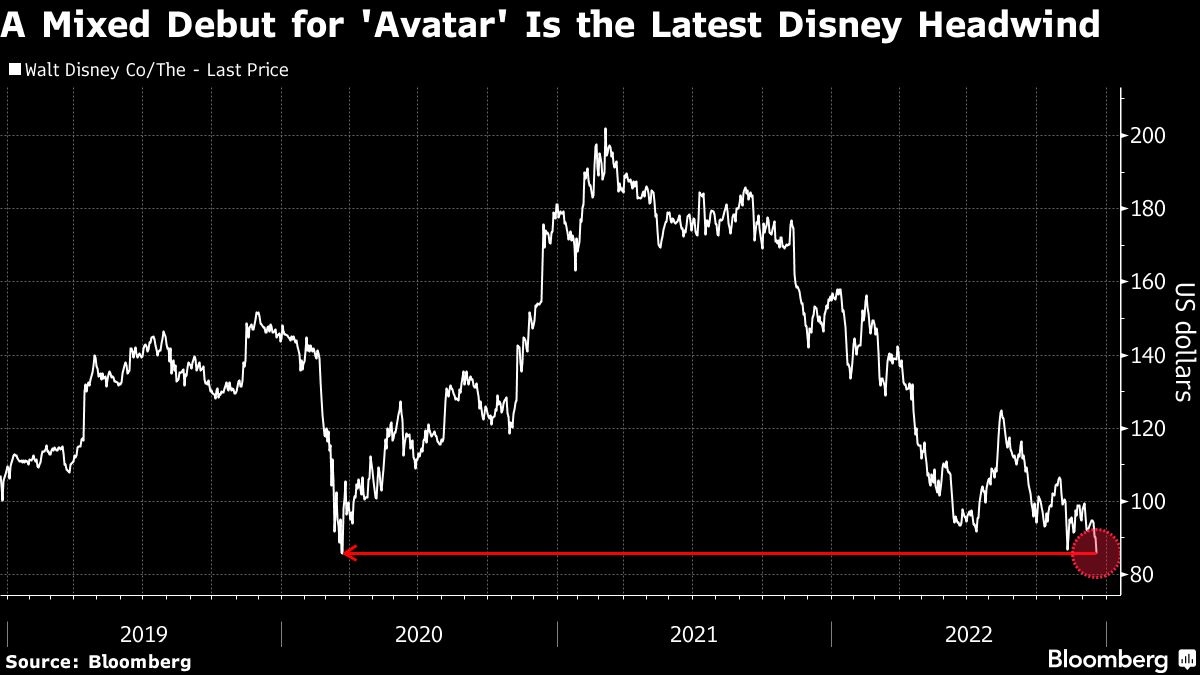

Walt Disney Co. fell on Monday, with the media company extending a lengthy selloff that took the stock to a more than two-year low.

Its shares fell 4.8 per cent to US$85.78, ending at their lowest since March 2020 after a fourth day of losses. The slump came after a somewhat disappointing opening weekend for the company’s Avatar: The Way of Water, one of the most expensive movies in Hollywood history. The film made US$53 million in its first two days of domestic release, and Disney lowered its guidance for the opening weekend.

The debut was the latest setback for Disney, which is down 45 per cent in 2022, putting it on track for its biggest annual decline in decades. Last month, it reported disappointing quarterly results, spurring the biggest drop for the stock since 2001. The report contributed to the company bringing back Bob Iger to replace Bob Chapek as chief executive officer.

While Avatar’s box office fell short of some estimates, analysts remain optimistic about the film’s long-term prospects.

“It is still early in the holiday season, with limited competition, and generally favorable reviews” for the film, wrote Truist Securities, which has a buy rating on the stock. Other firms suggested that ticket pre-sales indicated audiences are waiting to see the film in Imax Corp.’s large-screen theaters.