Jul 14, 2021

Distressed-Debt Funds Get No Love as Credit Problems Disappear

, Bloomberg News

(Bloomberg) -- Private debt investors are turning away from distressed funds amid shrinking opportunities to profit from troubled companies.

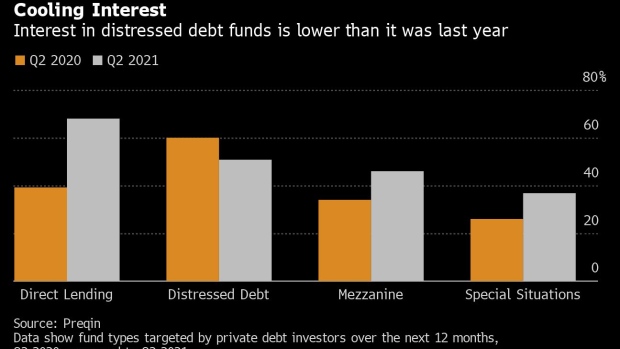

Investors were less keen to put their money to work in funds that target distressed credits in the past quarter than a year ago, according to a poll of allocation plans by Preqin. That contrasts with more enthusiasm for other private debt strategies like direct lending and mezzanine funds.

The world of distressed debt is being shrunk out of existence by a pandemic rebound whose ferocity has caught out an industry that thrives on misery. The share of distressed or stressed credits has fallen to a decade low, according to data compiled by analysts at Bloomberg Intelligence, with just 0.5% of Europe’s junk bonds trading at these levels, versus 39% at the peak of the crisis in 2020.

“The extent and amount of distress have so far not lived up to expectations from the early days of the pandemic,” according to Preqin. “Any severe distress, at this point, seems to be in the rear-view mirror.”

Distressed debt funds are already sitting on $15 billion of dry powder. With so much cash lying idle, returns are also coming under pressure.

Read more: Irrational World of Distressed Debt Leaves $15 Billion Idle

To be sure, this could all change very quickly. Unprecedented support from European governments and central banks has staved off default and propped up the shakiest companies. As these measures are wound down, fragile corporate balance sheets will be exposed -- and could offer a chance for distressed debt specialists to swoop in.

It’s likely that “fund managers are expecting opportunities when government support ends and more companies declare bankruptcy or require emergency funding,” according to Preqin. “Whether there is sufficient deal flow for funds to deploy the capital they have raised remains to be seen. Many investors and fund managers will wait for the dust of the pandemic-induced fallout to settle, revealing the best opportunities in the asset class.”

Europe

Global credit markets have become so subdued that investors are focusing on a more humdrum source of profits: coupons.

- U.K. consumer prices accelerated more than expected for a second month in a row, a surprise that may challenge the Bank of England’s argument that the surge will be temporary. Consumer prices climbed 2.5% from a year earlier, exceeding all but two estimates in a Bloomberg survey of 35 economists

- The U.K. is planning a second syndicated green gilt sale later this year, following an inaugural offering scheduled for September

- It’s a busier-than-expected day in the European primary market, particularly given that it’s Bastille Day in France. There were 6 deals with a value of at least 2.3 billion euros ($2.7 billion).

Asia

Asia’s primary dollar bond market slowed Wednesday with only one borrower, South Korea’s KT Corp., preparing to price notes after a flurry of deals earlier this week.

- Urban Renaissance Agency, a semi-governmental organization in Japan, is planning to sell social debt securities in yen for its latest such offering

- HDFC Bank Ltd., India’s biggest lender by market capitalization, may sell its first-ever offshore bonds that qualify as capital as it boosts buffers

- China Huarong Asset Management Co.’s local and dollar notes have been dropping anew as investors wait for clarity over the bad-debt manager’s fate

- Super-long dollar bonds of Southeast Asian oil companies, who are large issuers of such debt, have bolstered returns for investors in that region recently, but now face headwinds as inflation concerns build

- Read also: China State-Owned Firms Placed on Watch for Possible Downgrade

U.S.

Apollo Global Management Inc. is in talks to acquire a portfolio of assets from communications infrastructure specialist Lumen Technologies Inc., according to people with knowledge of the matter.

- Limetree Bay Refining LLC filed for Chapter 11 bankruptcy after the U.S. Environmental Protection Agency closed its Caribbean oil refinery

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

©2021 Bloomberg L.P.