Fancy Apartment Rentals for Paris Olympics See Poor Demand and Price Cuts

Locals who’d hoped to turn a big profit by renting out their posh apartments are now slashing prices by 30%-60%.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Locals who’d hoped to turn a big profit by renting out their posh apartments are now slashing prices by 30%-60%.

The kingdom must overcome a conservative image and concern about human rights. Visit the desert oasis town of AlUla to understand the challenge.

Jury selection was completed Friday for Donald Trump’s first criminal trial, setting the stage for opening arguments Monday in a New York case accusing the former president of falsifying business records to conceal a sex scandal before the 2016 election.

Higher-than-expected interest rates amid persistent inflation are perceived as the biggest threat to financial stability among market participants and observers, according to the Federal Reserve.

Fifth Third Bancorp jumped the most in four months, leading bank stocks higher, with Chief Executive Officer Tim Spence predicting that income from lending has bottomed out.

May 23, 2018

, Bloomberg News

(Bloomberg Opinion) -- Proponents of the rollback of Dodd-Frank financial regulations — which the House passed on Tuesday and is known unofficially as the Crapo bill for the Republican Idaho senator who has pushed it through — have said none of the changes should raise fears of another financial crisis. House Speaker Paul Ryan cheered the bill, implying the only rules being scrapped were those that were never needed in the first place and were actually damaging the economy.

Breaking news→ The House just voted to free our economy from overregulation. Main Street banks are engines of growth, and now it will be easier for these banks to lend to #SmallBiz and families.

— Paul Ryan (@SpeakerRyan) May 22, 2018Most of that assessment seems to be based on the fact that relatively few of the bill’s benefits will go to the nation’s biggest banks. The most notable change will raise the asset level at which banks start to face stricter regulation from the Federal Reserve and others to $100 billion from $50 billion for some regulations and as high as $250 billion for the most stringent ones. Companies as big as American Express Co. and SunTrust Banks Inc. will soon no longer have to undergo the scrutiny of public annual stress tests. (Changes elsewhere, of course, could lead to the end of the stress tests entirely.)

Most of the changes, though, benefit small and midsize banks, which will have the ability to take on more risk. The most urgent issue is that this new freedom is coming when the bread and butter of these smaller banks, commercial real estate, is drawing caution from their larger brethren. Earlier this week, Wells Fargo CEO Tim Sloan told Bloomberg that concern is growing at his bank about the commercial real estate market. Officials at Bank of America have said the same, warning that a bubble in real estate lending could be forming.

As of the end of the first quarter, banks with assets between $10 billion and $250 billion, according to data from the Federal Deposit Insurance Corp. — the ones getting the most relief from the Crapo bill — had 14.6 percent of their total assets in commercial real estate loans, up from just more than 12 percent at the beginning of 2016. Big banks, however, those with more than $250 billion in assets, had just 6.3 percent of their total assets in commercial real estate loans, about the same as two years ago. Banks with less than $1 billion in assets, which alone pose little threat to the economy but nonetheless can still pump up lending bubbles, had collectively 32 percent of their assets in commercial real estate lending at the end of the first quarter. The Crapo bill also relaxes a rule that requires all banks to hold more capital against some of the riskiest commercial real estate loans.

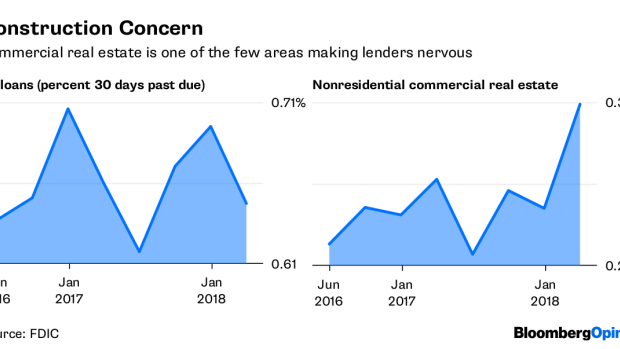

The biggest issue in commercial real estate is the withering health of traditional retailers. At all banks, the percentage of loans secured by nonresidential properties, the biggest real estate category after single-family loans, that are not current is still a low 0.6 percent, down from nearly 2.5 percent five years ago. But the percentage of loans that are 30 to 89 days past due is rising, one of the few areas, along with credit cards, that is flashing early warning signs of potentially rising defaults in the current good economy. Another growing concern is condo prices in cities such as Miami and New York. Bankers say they are becoming overheated as new luxury properties continue to go up, further evidence of a potential bubble in overall real estate lending.

There is a general consensus among regulators and those who write the rules that only big banks can cause financial crises. That was true the last time around. But the time before that, the savings and loan crisis stemmed from the absence of rules that would have prevented the nation’s smallest banks from going overboard. The result was more than a thousand bank failures in the early 1990s that significantly damaged the economy. The point of bank regulation should be to anticipate and avert as many financial crises as possible, not just a repeat of the last one.

To contact the author of this story: Stephen Gandel at sgandel2@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

©2018 Bloomberg L.P.