Jun 9, 2023

Dollar Purchases in Venezuela Jump Despite Tax: Chart

, Bloomberg News

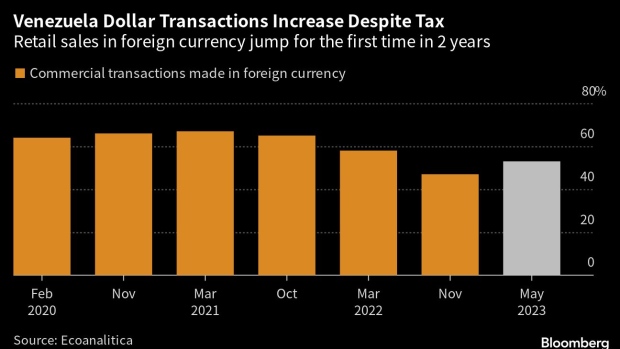

(Bloomberg) -- A tax on foreign-currency transactions imposed by the Venezuelan government is failing to rein in the use of the US dollar.

The share of transactions in foreign currency jumped to 53% in May, compared to 47% six months earlier, according to Caracas-based consultancy Ecoanalitica. The jump, the first in two years, comes despite a bid by the Nicolas Maduro administration to promote the use of the local currency, the bolivar, by imposing a 3% tax on dollar purchases.

There are about $4.8 billion in cash circulating in the country, Ecoanalitica estimates, almost four times the amount of bolivars and the largest amount since the government first allowed foreign currency to legally circulate back in 2019.

©2023 Bloomberg L.P.