Mar 21, 2023

Dovish Hike, or Hawkish Hold? Fed, Peers Must Choose Their Fear

, Bloomberg News

(Bloomberg) -- From Washington to Zurich to London, central bankers need to make a pivotal decision in coming days: whether their biggest immediate fear is financial or price stability.

The Federal Reserve on Wednesday will set the tone as Chair Jerome Powell gathers with his colleagues to consider whether the banking turmoil that erupted less than two weeks ago is so concerning that an interest-rate hike should be abandoned.

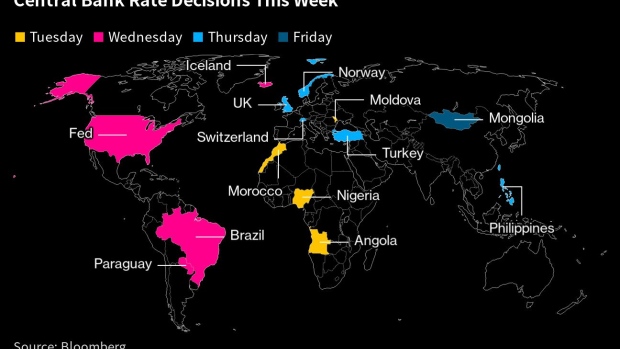

The UK, Swiss and Norwegian central banks are among more than a dozen others that also will be setting rates this week. And while the European Central Bank opted to pull the rate trigger last Thursday, the downfall of Credit Suisse Group AG — and default on its bondholders — since then poses fresh questions for policymakers.

Tilting toward safeguarding finance by keeping rates on hold could reassure investors that regulators will do what it takes to ensure contagion from three US bank collapses, and now Credit Suisse’s demise, will be contained.

Trouble is, above-target inflation remains stubborn, and Powell and his peers are well aware of the history of the 1970s, when insufficient tightening helped to entrench outsize price gains.

“Financial crises tend to move in fits and starts and we’re still far from a full resolution from this one,” said Diane Swonk, chief economist at KPMG LLP. For the Fed, “we’re looking for a pregnant pause given the uncertainty about what tightening is in the credit markets already,” she said.

Speaking to how quickly things have changed, Swonk earlier this month, had penciled in a 50 basis-point hike for March 22.

Communication Challenge

Central bankers face “a choice between ‘a dovish hike’ versus ‘a hawkish hold,’” Geoffrey Yu, a senior market strategist at Bank of New York Mellon, wrote in a note Monday.

In other words, policymakers could boost rates further while assuring the public that they are attuned to risks in the banking system and will act appropriately to avert any broader meltdown.

Or they could stand pat for now to buy time to see how financial developments unfold, while pledging to resume the inflation battle swiftly once stresses subside.

Futures markets show odds-on bets for a 25 basis-point move by the Fed on Wednesday. For the Bank of England — which started hiking months before the Fed — there’s less than a 50-50 chance of an increase on Thursday, when the Swiss National Bank also must make a call, just days after helping oversee Credit Suisse’s takeover by UBS Group AG.

Regardless of what they do this week, markets see central banks much closer to being done with tightening than it appeared just days ago.

For the Fed, traders were betting on another 110 basis points of hikes before the troubles at Silicon Valley Bank escalated — implying a peak rate of almost 6%. As of Monday, they were pricing in just another 35 basis points. Further out the curve the market is betting on cuts.

It’s a similar picture in Europe, where traders have repriced their terminal-rate expectations for the ECB by an entire percentage point, to 3.2%. The BOE is now seen raising rates to at most 4.25%, compared with 5% previously.

The markedly more-dovish outlook has also helped fuel a strong bond rally. The yield on two-year German and US government bonds — those most sensitive to policy — have fallen 100 basis points or more since March 8.

Policy Divergence?

Both now sit at or below their respective central bank key rates, another sign for many traders that policymakers are quickly nearing the end of their rate-hike cycles.

Central banks may well decide to make different calls.

In Switzerland, economists predict a half-point rate rise to 1.5% as the SNB plays catch-up with the neighboring euro zone in its first decision of 2023. However, at 3.4%, Swiss inflation is low compared with much of the advanced world.

A day before the BOE decides, official inflation data is expected to show a slowing from 10.1% to 9.9%.

ECB President Christine Lagarde, in overseeing a half-point rate hike last week, insisted that price stability and financial stability “are two different stabilities addressed by different tools.”

But rate increases have been blamed for contributing to the banking crisis that’s now erupted.

“Recent economic momentum and inflation have been overshadowed by banking system risks, sharply repricing the Fed’s path,” as Bank of America rates strategist Mark Cabana said in a note.

--With assistance from Constantine Courcoulas, Catarina Saraiva and Edward Bolingbroke.

©2023 Bloomberg L.P.