Feb 21, 2023

Dow Average's 2023 rally evaporates in rate reset

, Bloomberg News

BNN Bloomberg's closing bell update: Feb. 21, 2023

A renewed surge in Treasury yields took the wind out of the stock market, with geopolitical tensions and dire forecasts from bellwethers Walmart Inc. and Home Depot Inc. also souring investors’ mood.

Wall Street’s growing fears that the Federal Reserve is nowhere near wrapping up its war against inflation — let alone pivoting — continued to burn bond investors who at one point were betting on rate cuts this year. As traders ramped up their Fed wagers, U.S. yields reached new highs for 2023. And the last ones to join the so called “everything rally” — equities — are now giving signs of running out of steam.

In a selloff that engulfed every major group in the S&P 500, the gauge wiped out its monthly advance and had its worst slump since mid-December. Over 90 per cent of its shares fell. The Dow Jones Industrial Average erased its 2023 gains. Tech stocks underperformed, with the Nasdaq 100 down more than 2 per cent. Equity volatility, which had been stubbornly low earlier this year, continued to surge — with the so-called VIX near 23.

While recent economic data suggest the U.S. might be able to dodge a recession, a hawkish Fed and elevated earnings projections make the risk-reward for equities look “very poor,” said Morgan Stanley’s Michael Wilson. That doesn’t bode well for the market after a sharp rally that has left stocks at their most expensive levels since 2007 by the measure of equity risk premium.

“It is at a point where equity markets feel like they’re a bit overpriced given where we are,” Liz Young, head of investment strategy at SoFi, told Bloomberg Television. “The Fed still has to do more, and we all know about the long and variable lags that it takes for monetary policy changes to move their way through the economy. It’s difficult for me to look at this in this environment and say, ‘yes, we should be paying 18-times forward earnings.’”

TOO FAR

Others on Wall Street have also warned that the recovery in stocks may have gone too far.

JPMorgan Chase & Co.’s Mislav Matejka said bets on resilient economic growth and a Fed pivot are premature, while Bank of America Corp. strategist Michael Hartnett sees the S&P 500 dropping to 3,800 points by March 8 — implying declines of about 7 per cent from its last close. Wilson is far more pessimistic and holds a view the index can slide to as low as 3,000 — a 26 per cent plunge from Friday — in the first half of 2023.

Eric Johnston at Cantor Fitzgerald said he remains bearish on equities — and his conviction remains high. Johnston added he couldn’t disagree more with the view that the U.S. will see no recession and may instead have a soft landing or no landing. The current performance of the economy is not an indication of what it will look like 6-12 months from now, he noted.

There’s also the fact that solid economic data continue to spell trouble as far as Fed policy goes.

Indeed, equities came under pressure Tuesday even after data showed U.S. business activity steadied in February as the service sector regained its footing, suggesting a strong economy that is keeping some pricing power intact.

“A tight labor market and resilient consumer demand could goad the Federal Reserve to maintain its rate hiking campaign into the summertime,” said Jeffrey Roach, chief economist for LPL Financial. “Investors should expect volatility until markets and central bankers come to agreement on the expected path for interest rates.”

VULNERABLE TO ‘SHOCKS’

For now, swaps are showing firm conviction that the Fed will keep pushing rates higher — with the market indicating that 25-basis-point hikes are coming at the March, May and June meetings. Investors are pricing in federal funds rate climbing to around 5.3 per cent in June. That compares with a perceived peak of 4.9 per cent just three weeks ago.

“If rates are closer to 5 per cent for longer, valuations incorporating extremely modest risk premiums will likely be very vulnerable to market shocks,” said Lisa Shalett, chief investment officer at at Morgan Stanley Wealth Management. “Investors should note that a ‘higher-for-longer’ Fed will likely not only reset the terminal rate, but also the longer-term neutral rate — generating headwinds for long-duration valuations.”

Markets are still trying to adjust to the reality that the Fed is unlikely to pivot and is instead still focused on fighting inflation, which suggests that investors should be prepared for interest rates to stay higher for longer, said Carol Schleif, chief investment officer at BMO Family Office. That means, “we could see continued volatility through year-end.”

Schleif also notes that Wednesday’s Fed minutes will be particularly relevant given the recently released inflation and jobs numbers, which are still elevated and illustrative of a hot economy. The Fed’s preferred inflation gauge later this week — along with a groundswell of consumer spending — are seen fomenting debate among central bankers on the need to adjust the pace of rate increases.

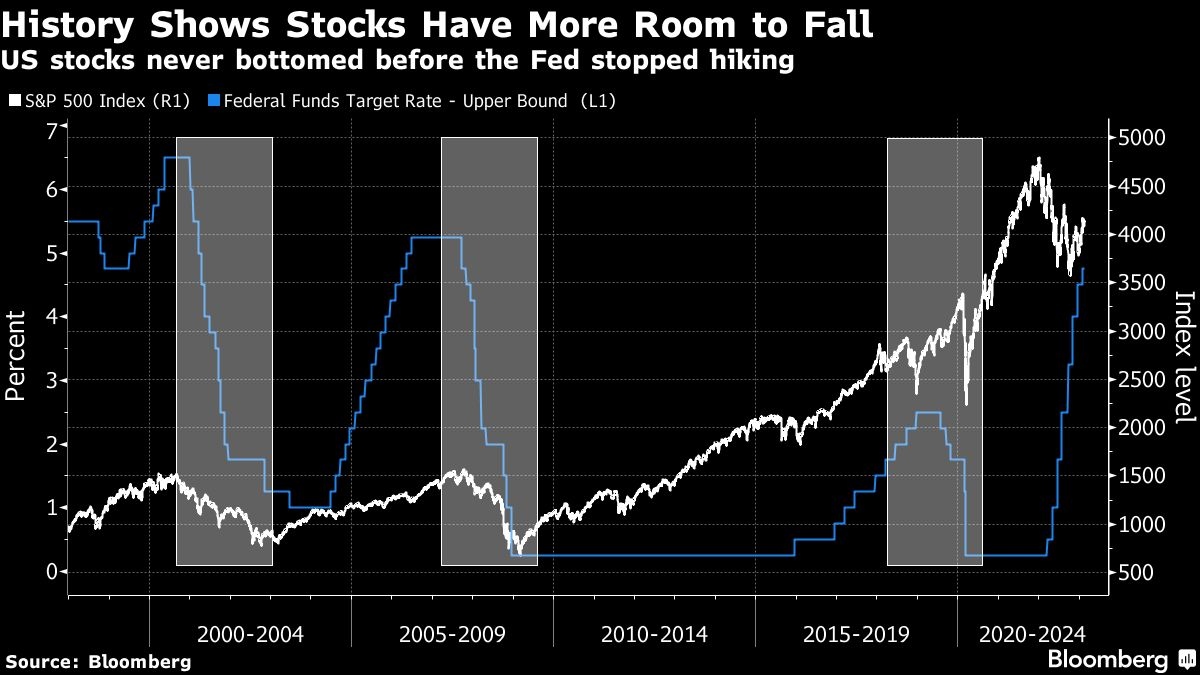

If history is any guide, the stock market hasn’t indeed found a bottom yet.

The S&P 500 hit a low only after the Fed stopped raising rates in previous hiking cycles, according to data compiled by Bloomberg, implying more downside if the trend holds true. US equities rallied 17 per cent from an October low to a high in early February, before gains began to fade.

The latest JPMorgan Chase & Co. client survey shows that equity positioning is still skewed toward the bearish percentile and only 33 per cent of respondents said they are likely to increase exposure in the coming weeks.

As the US earnings season winds down, traders will be interested in hearing from one of this year’s top performers in the S&P 500: Nvidia Corp.

The company is set to report fourth-quarter results Wednesday at a tumultuous time for the chipmaker. Though the personal-computer industry continues to struggle, the firm’s prospects in data centers and artificial intelligence have bolstered the shares in 2023. In the run-up to its report, the shares extended a four-day rout to about 10 per cent.

“The question now is whether NVDA’s earnings report tomorrow can help the stock regain its upside momentum,” said Matt Maley, chief market strategist at Miller Tabak + Co. “If it can, it will not just be positive for the stock, but it will be positive for the chip sector overall. Since the semiconductors are such an important leadership group in the stock market, a positive report could/should be important on a broader basis as well.”

LATEST ‘DOMINO’

To Lauren Goodwin at New York Life Investments, US earnings results are the latest “domino” to topple in a line of data pointed toward recession ahead.

“While bottom line results have held well, reflecting companies’ impressive ability to maintain margins, top line revenues are decelerating for most industries,” Goodwin added. “As higher interest rates continue to slow economic activity, albeit with long and variable lags, we believe those companies with more durable revenues will once again outperform.”

Investors also kept a close eye on the recent geopolitical developments.

President Vladimir Putin said Russia will suspend its observation of the New START nuclear weapons treaty with the US, a decision Secretary of State Antony Blinken called “irresponsible.” President Joe Biden hit back at Putin, saying he would never win his war in Ukraine.

Meantime, the White House won’t be afraid to sanction Chinese companies that support Russia’s invasion of Ukraine, Deputy Treasury Secretary Wally Adeyemo said.

Elsewhere, Credit Suisse Group AG hit a record low on a report that the chairman is facing a probe over comments he made that the firm had put a stop to huge client outflows after a run of share declines.

Key events this week:

- U.S. MBA mortgage applications, Wednesday

- Federal Reserve releases minutes from its latest policy meeting, Wednesday

- Eurozone CPI, Thursday

- U.S. GDP, initial jobless claims, Thursday

- Atlanta Fed President Raphael Bostic speaks, Thursday

- BOJ governor-nominee Kazuo Ueda appears before Japan’s lower house, Friday

- U.S. PCE deflator, personal spending, new home sales, University of Michigan consumer sentiment, Friday

- Russia’s invasion of Ukraine hits the one-year mark, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 2 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 2.4 per cent

- The Dow Jones Industrial Average fell 2.1 per cent

- The MSCI World index fell 1.6 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.3 per cent

- The euro fell 0.4 per cent to US$1.0647

- The British pound rose 0.5 per cent to US$1.2106

- The Japanese yen fell 0.5 per cent to 134.93 per dollar

Cryptocurrencies

- Bitcoin fell 1.2 per cent to US$24,461.78

- Ether fell 1.9 per cent to US$1,669.08

Bonds

- The yield on 10-year Treasuries advanced 14 basis points to 3.95 per cent

- Germany’s 10-year yield advanced seven basis points to 2.53 per cent

- Britain’s 10-year yield advanced 14 basis points to 3.61 per cent

Commodities

- West Texas Intermediate crude fell 0.2 per cent to US$76.16 a barrel

- Gold futures fell 0.3 per cent to US$1,843.90 an ounce