Oct 7, 2020

DraftKings sinks on share sale and virus wreaking NFL havoc

, Bloomberg News

DraftKings stock under pressure after equity offering, COVID-19 risks

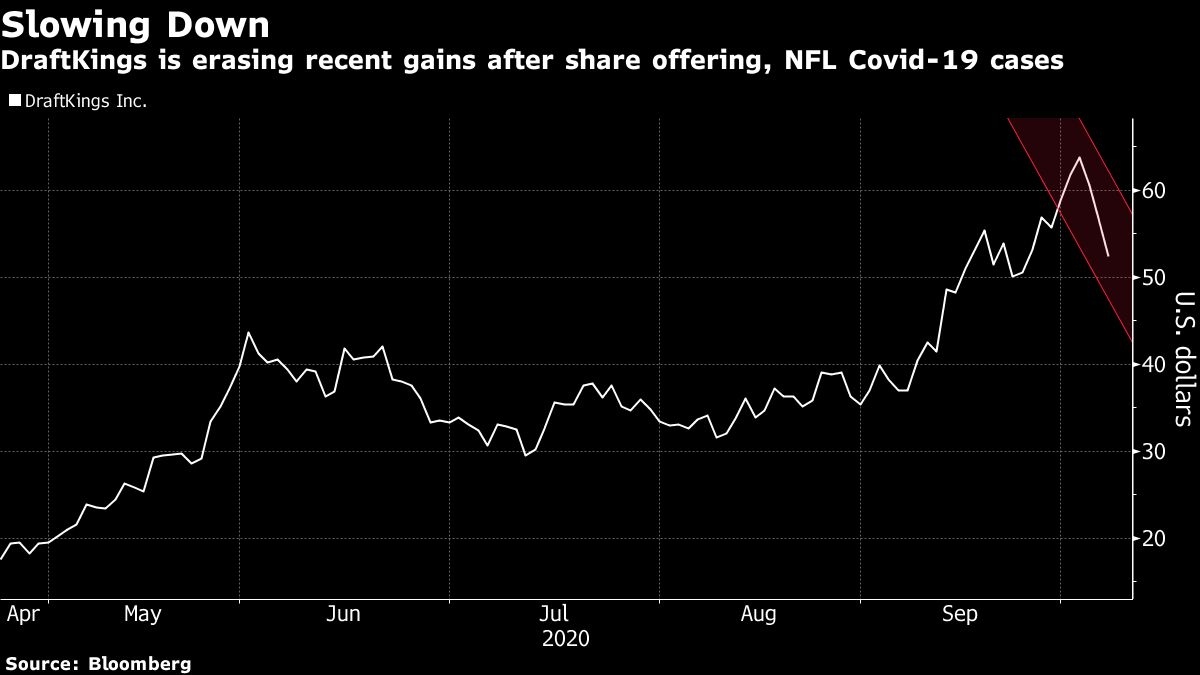

The pricing of a DraftKings Inc. share sale combined with a fresh wave of COVID-19 infections across the National Football League sent shares of the online gaming company tumbling Wednesday morning.

The US$1.67 billion sale from DraftKings and some early investors was priced at $52 a share, an 8.4 per cent discount to Tuesday’s close and 18% lower than Friday’s record. The initial selloff for Boston-based DraftKings accelerated after players from the New England Patriots, Tennessee Titans, and Las Vegas Raiders tested positive for COVID-19, according to social media posts.

DraftKings shares fell as much as 8.1 per cent at 10:09 a.m. in New York, sending the stock toward its worst three-day decline since its reverse merger in April. Meanwhile, Barstool Sports Inc.-minority owner Penn National Gaming Inc. shook off an initial dip to rise 0.9 per cent.

The offering of shares from both DraftKings and early investors like New England Patriots owner Robert Kraft was announced after the stock capped a 264 per cent surge from an April debut on Monday. The timing of Kraft’s sales may seem problematic to some DraftKings skeptics, given Tom Pelissero of the NFL Network reported Wednesday morning that Patriots All-Pro defensive back Stephon Gilmore tested positive on Tuesday and that the team would cancel practice. The Patriots were also without starting quarterback Cam Newton on Monday when it played the Kansas City Chiefs after he tested positive.

The additional positive tests across the NFL could put more games at risk of being postponed. The Titans, who had their Sunday game postponed after a number of players tested positive, won’t be able to return to their facility after the latest cases, which puts their meeting with the Buffalo Bills in jeopardy.

Both college football and the National Football League are key leagues for sports betting books. DraftKings director of bookmaking Johnny Avello said in an interview this summer that football makes up about a third of the company’s action.