Sep 11, 2019

Draghi gears up for ECB showdown on stimulus

, Bloomberg News

ECB Doubters Drive the Great Divide Over Stimulus

Mario Draghi faces one of the most contentious policy meetings of his European Central Bank presidency on Thursday as he prepares to ramp up monetary stimulus again despite skepticism from the euro area’s biggest economies.

The mood is expected to be tense when the 25-member Governing Council discusses how to respond to fading growth and inflation, according to officials who spoke on condition of anonymity. While interest rates will almost certainly be cut further below zero, governors from nations including Germany, France and the Netherlands have warned they see no compelling need to resume quantitative easing.

The blows of trade wars and Brexit have forced Draghi into an about-turn just nine months after he signaled the ECB was done cutting rates and buying debt. It’s a remarkable shift, weeks before he’s due to be replaced by former International Monetary Fund chief Christine Lagarde.

Yet his impending exit, and the arrival of several new governors on the council this year, appears to have energized the doubters over the wisdom of his radical measures. The last major opposition Draghi faced was in January 2015 when he pushed through large-scale asset purchases.

Economists and investors still anticipate some form of QE, meaning governors will need to consider the consequences of defying those expectations -- potentially higher market rates that could pose a risk to the economy. Peers from Australia to the U.S. have already eased policy as global growth slows, with the Federal Reserve expected to deliver its second rate cut of 2019 when it meets next week.

What Bloomberg’s Economists Say...

“Draghi is poised to restart stimulus at his penultimate meeting...While heads of the German, Dutch, Austrian and Estonian central banks are against restarting QE; Draghi has earned a reputation for getting his way.”

--Niraj Shah. See the ECB Spectrometer

Here’s what to look out for when the ECB’s decision on rates and any other measures is announced at 1:45 p.m. in Frankfurt, and Draghi holds his press conference 45 minutes later.

Lower Rates

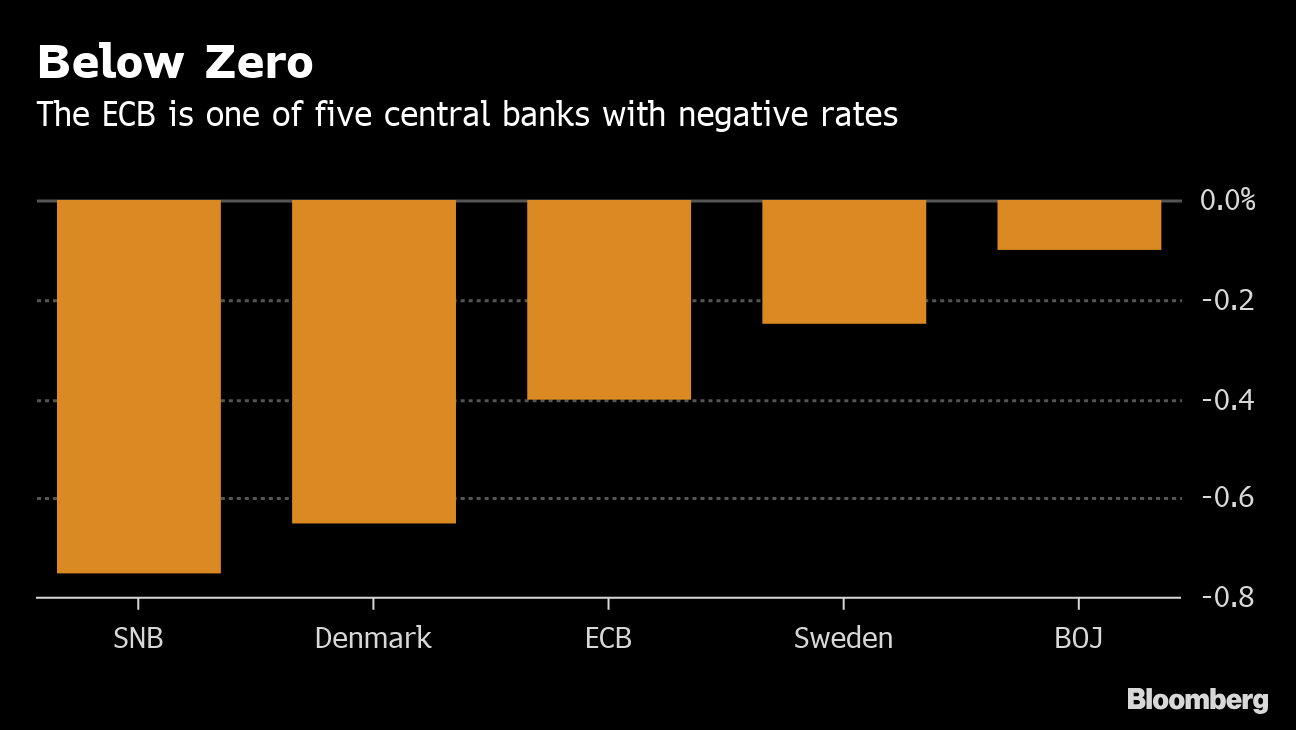

A rate cut seems to be the least controversial part of the stimulus package policy makers are set to discuss -- despite criticism from some countries in the region’s core that savers and banks are already hurting enough after more than five years of negative rates.

All but one economist in a Bloomberg survey predict the deposit rate will be lowered, with the median estimate for 10 basis points. Investors are bolder, pricing in some 15 basis points of easing.

Quantitative Easing

A new round of bond buying is the main bone of contention. Bundesbank President Jens Weidmann and Dutch Governor Klaas Knot have argued the current economic situation doesn’t warrant QE, while France’s Francois Villeroy de Galhau also signaled skepticism.

Yet most economists still expect 30 billion euros ($33 billion) a month in asset purchases for one year. A program of that magnitude may require changing the rules on how much debt the ECB can buy of any given country -- a sticking point among officials.

Investors are banking on Draghi’s ability to overcome internal opposition, a skill he’s proven during his eight-year term. Finnish central banker Olli Rehn raised the stakes last month when he argued any stimulus package must exceed expectations to be effective.

Europe’s government bonds surged in August, driving yields on even 30-year German securities below zero, as investors speculated QE would be part of the ECB’s plan. Some of those bets were subsequently scaled back after critical comments from some officials.

Tiering

Banks are hoping the ECB will sweeten the pain of even more negative rates by exempting a share of their deposits from the policy. In doing so, it would follow the Bank of Japan and the Swiss National Bank, which have offsetting measures in place.

There is a reason why a so-called tiering system has been slow in coming. The exemption would mainly benefit institutions in Germany and France, which hold a significant portion of excess liquidity and make most use of the ECB’s deposit facility. It won’t necessarily help lenders in countries such as Italy that mainly borrow from the central bank.

Consumer Prices

Despite trillions of euros of stimulus, inflation is running at just half the pace of “below, but close to, 2%” that the ECB strives for over the medium term. Economists predict it will cut its forecasts for this year and next, feeding policy makers’ concerns that investors could lose faith in their ability to revive price growth.

Draghi has already stressed the ECB will treat its target symmetrically, meaning it could tolerate higher inflation after more than half a decade of almost constant undershooting. To underpin that commitment, the Governing Council may change its communication on the path of interest rates by promising that policy will remain loose until progress is made.

Economic Slowdown

With Germany on the brink of recession and Italian growth stalling, the ECB has plenty of reasons to act. Yet the domestic economy has so far proved resilient, with unemployment at a decade low and second-quarter growth driven by consumption and investment.

The weakness largely originates from abroad: Trade tensions have rocked manufacturers and exporters, and worse might be to come if Britain crashes out of the European Union without a deal. That latter risk could materialize as soon as Oct. 31, the day Draghi hands the baton to Lagarde.

She has pledged to act with “agility” to steer the euro-area economy, but she has also called on governments to play their part with fiscal stimulus. That’s a common Draghi refrain as well -- expect to hear it again on Thursday.

--With assistance from James Hirai.