Oct 28, 2019

Canadians 'drowning in debt' as 47% struggle to cover costs: MNP

, BNN Bloomberg

Canadians feeling more concerned about repaying debt, survey shows

Nearly half of Canadians are facing a debt trap, according to a new survey that thrusts highly-leveraged households into the spotlight ahead of an upcoming interest rate decision by the Bank of Canada.

Forty-seven per cent of respondents to a survey conducted on behalf of insolvency firm MNP said they don’t expect to be able to cover basic living expenses over the next year without taking on more debt.

A slightly greater proportion (48 per cent) of respondents said they have less than $200 remaining at the end of the month after covering living expenses and debt payments; that was up four percentage points compared to the previous survey in June.

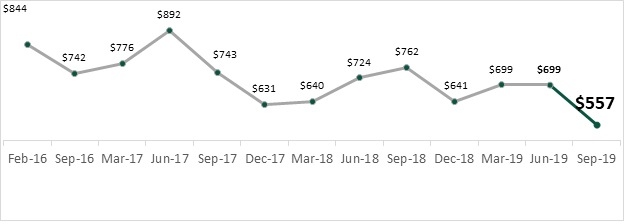

On average, respondents to the survey said they had $557 left after paying their monthly bills and obligations, marking a decrease of $142 from June.

“Household debt has eased marginally and the current holding pattern on interest rates may be giving Canadians a sense of optimism about their finances,” said Grant Bazian, president of MNP LTD, in a release Monday. “Still, the fact remains that many are drowning in debt and most don’t have a clear path to repayment."

Average Finances Left at Month-End

The lack of financial buffer is leaving certain Canadians particularly vulnerable to the unexpected. Indeed, the survey showed seven out of every 10 respondents were not confident about being able to handle an abrupt setback like divorce, unemployment, or death in the family.

“Unexpected expenses can plague people regardless of age or income but they're most devastating for people who already have a large amount of debt,” Bazian said. “Our research shows that most households do not have enough cash for inevitable life events like a car repair.”

The new anecdotal evidence of tight household finances comes ahead of a policy announcement by the Bank of Canada on Wednesday that will break a prolonged period of silence on monetary policy.

In the most recent official speech by a member of the Bank’s governing council on Sept. 5, Deputy Governor Lawrence Schembri said elevated household debt levels “remain the main risk to Canadian financial stability.” He also pointed out, however, that current tighter mortgage rules are helping to improve the quality of that debt.

The MNP survey of 2,002 Canadians was compiled by Ipsos from Sept. 4 to Sept. 9. MNP said the results are accurate within 2.5 percentage points, 19 times out of 20.

HAVE YOUR SAY

Which of these should matter most to the Bank of Canada right now?