May 2, 2023

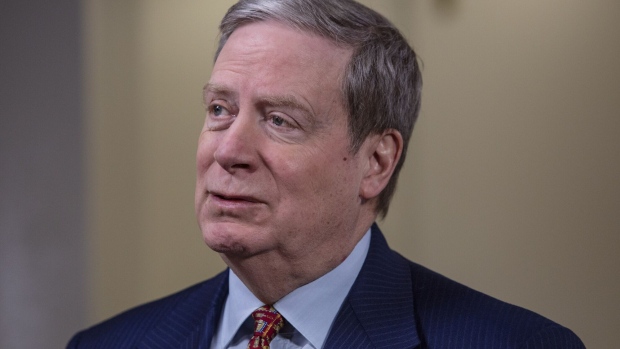

Druckenmiller Warns US Debt Crisis Worse Than He Imagined

, Bloomberg News

(Bloomberg) -- Stanley Druckenmiller, the legendary hedge fund investor and long-time deficit hawk, said the current impasse over the debt ceiling is dwarfed by the dangers of unchecked future government spending.

“The fiscal recklessness of the last decade has been like watching a horror movie unfold,” Druckenmiller, 69, who now runs his own Duquesne Family Office, said in a speech Monday at the University of Southern California Marshall School of Business.

In a follow-up email, he said he hopes the US government doesn’t go into default, “but honestly, all this focus on the debt ceiling instead of the future fiscal issue is like sitting on the beach at Santa Monica worrying about whether a 30-foot wave will damage the pier when you know there’s a 200-foot tsunami just 10 miles out.”

Druckenmiller’s comments echo those the billionaire investor gave a decade ago during a tour of 14 university campuses, when he encouraged students to pay attention to ballooning federal deficits that he believed could bankrupt future generations.

He said at the time that the economic storm spurred by reckless spending could dwarf the economic pains of 2008. The situation today “looks much worse than I had imagined 10 years ago,” he said on Monday.

The big issue is entitlements such as Social Security, Medicare and Medicaid, which without cuts today will have to be slashed in the future, he said. In the speech, he expressed concerns about the Biden administration’s plans to deal with the potential shortfalls, as well as the lack of fiscal restraint by the Republican party.

Spending on seniors will reach 100% of federal tax revenues by 2040 based on Congressional Budget Office estimates, he said, including interest expense. What’s more, the current $31 trillion US debt load doesn’t account for future entitlement payments. Accounting for the present value of that burden, the debt load is more like $200 trillion, he estimated.

Druckenmiller also questioned the actions of the Federal Reserve, saying the agency’s easy-money policies over the past decades created reckless behavior in financial markets, government and banks.

“Unfortunately, by still owning a large amount of government debt, the Fed continues to create the false illusion that it can help with our fiscal problems,” he said.

While raising interest rates 5 percentage points in the past year was a move in the right direction — “trying to correct the biggest mistake in Fed history” — Druckenmiller questioned the central bank’s resolve to stick to its guns.

“At the first signs of trouble, the Fed last month, and in just four days, undid most of the small progress they had made in reducing their balance sheet,” he said. “This asymmetric Fed response is what feeds the lack of serious structural action in DC from both sides of the aisle.”

Druckenmiller stopped managing money for outside clients in 2010 after three decades in the business, including more than a decade as chief strategist for billionaire George Soros. From 1986 through 2010 he produced average annual returns of 30%, one of the best long-term track records in the industry.

(Adds investing history in last paragraph. An earlier version of this story corrected the location of the speech.)

©2023 Bloomberg L.P.