Feb 22, 2020

Dumb Money Beats Smart Picking Big Winners in Stocks This Year

, Bloomberg News

(Bloomberg) -- Looking for the smart money in equities these days? Try taking a peek at your next-door neighbor’s portfolio.

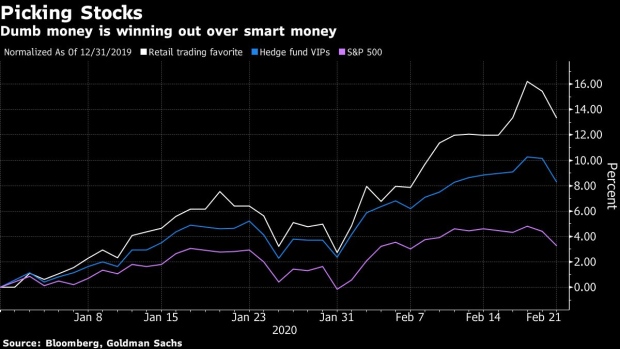

A basket of the 50 most-popular stocks among individual investors has rallied 13% this year, compared with an 8.7% gain for a gauge of hedge fund favorites, data compiled by Goldman Sachs Group Inc. show. While both exceed the benchmark S&P 500 by wide margins, the scorecard is good news for the recently emboldened retail class.

Of course, two months of returns don’t prove much, and professionals still hold the edge as far as frequency of gainers goes. More than 85% of their stocks have risen this year, compared with 70% for retail money. They didn’t catch as many blockbusters, though. Only two of their popular holdings have gained at least 50%: Tesla Inc. and PG&E Corp.

By contrast, individual investors scored seven such wins. Besides Tesla and PG&E, they reaped big pay-offs from Virgin Galactic Holdings Inc., Plug Power Inc., Sprint Corp., Vivint Solar Inc. and Beyond Meat Inc.

“Retail investors tend to buy what’s just done well, and in a market like we’ve been in the last several years, that’s worked very well,” said Rich Weiss, chief investment officer of multi-asset strategies at American Century Investments. “If that type of outperformance by the retail basket over the hedge fund basket would persist for another year or longer, that makes quite a statement, if not an indictment, on professional money managers.”

The success may have bolstered optimism among small investors, who are rushing back to the market after some brokerages eliminated commissions on trades. According to the latest sentiment reading from the Conference Board, the share of respondents expecting stocks to rise in the next year advanced to 43.1% in January, the highest since October 2018.

Retail investors have gravitated more toward smaller companies. Sixteen of their top 50 picks have market values less than $10 billion, compared with six for hedge funds. At $45 billion, the median market capitalization of their stocks is about half that for professional picks.

And when they lose money, they also lose big. Seven of their stocks have fallen at least 10% this year, including Chesapeake Energy Corp. and Groupon Inc. Meanwhile, all of the hedge funds’ top selections have fared better.

As far apart as their performance has been, the two sets of investors share some tastes. Among their 50 favorite stocks, 13 overlap. Of particular note is their affection for tech giants Apple Inc., Amazon.com Inc., Facebook Inc. and Microsoft Corp.

To Goldman strategists including Ben Snider and David Kostin, the recent surge in retail trading activity is helping professional money managers. The hedge fund industry has been struggling to keep up with the market partly because of their reluctance to chase the equity rally.

“Because many favorite retail stocks are also popular with hedge funds, the retail trading surge has also benefited the performance of hedge fund long portfolios,” the strategists wrote to a note to clients.

--With assistance from Aoyon Ashraf.

To contact the reporter on this story: Lu Wang in New York at lwang8@bloomberg.net

To contact the editors responsible for this story: Brad Olesen at bolesen3@bloomberg.net, Richard Richtmyer

©2020 Bloomberg L.P.