Feb 1, 2022

EA Revenue Forecast Misses Estimates After Battlefield Flop

, Bloomberg News

(Bloomberg) -- Electronic Arts Inc. gave a forecast for revenue and earnings in the current quarter that missed analysts’ estimates, suggesting that even the ongoing success of Apex Legends isn’t enough to offset a new Battlefield flop. The shares fell about 6% in extended trading.

The game publisher, also known for sports franchises like Madden NFL and FIFA, predicted fourth-quarter adjusted revenue of $1.76 billion, missing the average analyst projection of $1.82 billion. Earnings per share excluding some costs will be $1.38, compared with the average analyst estimate of $1.49.

EA’s big fall title, Battlefield 2042, received poor reviews from fans and critics when it was released in November after a month’s delay. It has a score of 61 out of 100 on Metacritic, a website that aggregates reviews. A critic for the Washington Post wrote that “the overall Battlefield experience is sorely lacking” in the new game. The developer, Stockholm-based Dice, said Tuesday it was delaying the game’s first season of content until the summer.

Investors have already written off Battlefield 2042 as a “failure, reinforcing the ‘same old EA’ reputation,” analysts at BMO Capital Markets wrote in a note to investors before the results were released.

Despite the big Battlefield disappointment, EA has found continued success with its online shooter game Apex Legends. The Redwood City, California-based company said last week that Respawn, the maker of Apex and one of EA’s key development studios, is working on three new Star Wars titles, including a sequel to 2019’s successful Star Wars Jedi Fallen Order.

For the fiscal third quarter, EA reported adjusted revenue $2.58 billion, missing analyst projections of $2.67 billion. Earnings per share were $3.20. Analysts estimated $3.23.

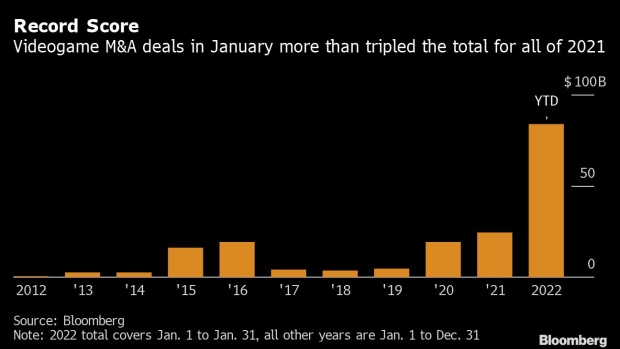

With dealmaking in the gaming industry at an all-time high in January, just one month into 2022, EA is expected to be a hot commodity in what’s expected to be ongoing consolidation. Microsoft Corp.’s agreement to buy Activision Blizzard Inc. for almost $69 billion, heightens “the appeal of EA’s strong video game library, said Bloomberg Intelligence analyst Amine Bensaid.

EA named Chris Suh, a Microsoft Corp. executive, as its new chief financial officer earlier this week. Suh, whose appointment is effective March 1, will replace Blake Jorgensen, who had previously announced plans to step down after nearly a decade at the company.

EA shares are down about 1.5% so far this year, less than Take-Two Interactive Corp.’s 10% decline but lagging behind Activision’s 19% gain spurred by the Microsoft acquisition.

©2022 Bloomberg L.P.