(Bloomberg) -- Investors looking for clues on where Australia’s economy is headed may find the answer in earnings results, with August shaping up as a bleak month for equity investors.

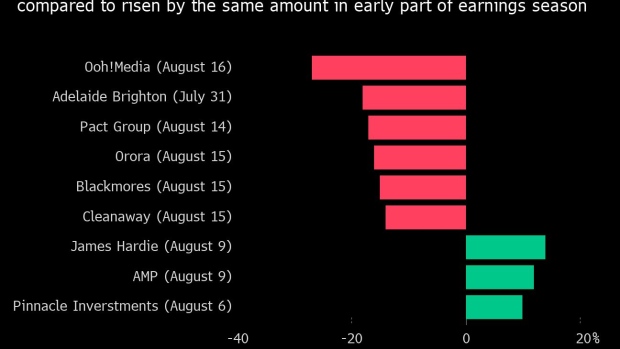

Of the 43 companies that have reported full-year results so far this month, 64% missed earnings estimates, according to data compiled by Bloomberg. August could be challenging if that trend continues, as the market fell for a third straight week, pulling back from last month’s record high.

“In addition to the geopolitical crosswinds buffeting markets, we remain concerned by stretched valuations in the local market and the invariably severe downdraft experienced by those that miss the mark,” JPMorgan Chase & Co. analysts led by Jason Steed wrote in a Aug. 15 note.

Yet the picture isn’t clear cut. Divergent corporate commentary, geopolitical issues and low rates have led to a “puzzling start to the season,” JPMorgan analysts wrote.

Companies can’t agree on their outlook for the domestic economy. REA Group Ltd.’s Chief Executive Officer Owen Wilson proclaimed on an earnings call that the “buyers are definitely back” in the housing market, while bank results point to tepid lending growth.

Add threats from outside Australia, and it’s hard to gauge how the nation is faring in an environment that includes back-to-back interest rates cuts in June and July and the slowest pace of economic growth in a decade in the first three months of the year.

“Rarely have we seen a reporting season intersect with such elevated geopolitical tensions” like Brexit, the U.S.-China trade war and protests in Hong Kong, as well as “never-before seen levels of the cash rate,” JPMorgan said.

--With assistance from Tim Smith.

To contact the reporter on this story: Jackie Edwards in Sydney at jedwards160@bloomberg.net

To contact the editors responsible for this story: Lianting Tu at ltu4@bloomberg.net, Rebecca Jones, Margo Towie

©2019 Bloomberg L.P.