Jun 15, 2022

ECB Accelerates Work on Crisis Tool After Italian Bond Blowout

, Bloomberg News

(Bloomberg) -- The European Central Bank instructed committees to create a new tool to combat unwarranted jumps in euro-area bond yields as markets strain at the prospect of the first interest-rate increases in more than a decade.

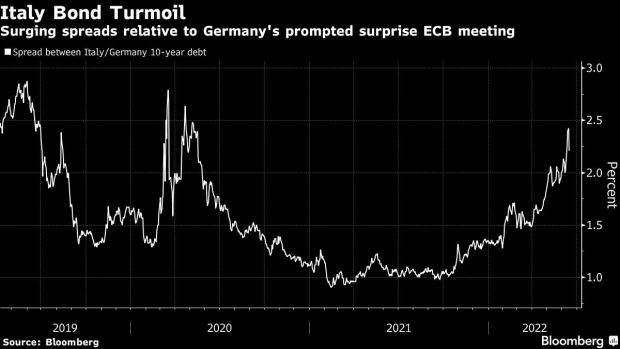

Following an emergency meeting Wednesday, convened after Italian yields surged to the highest since Europe’s sovereign-debt crisis, the Governing Council also said it will apply flexibility in reinvesting redemptions coming due in its pandemic portfolio, with a view to preserving the functioning of the monetary policy transmission mechanism.

“The pandemic has left lasting vulnerabilities in the euro-area economy which are indeed contributing to the uneven transmission of the normalization of our monetary policy across jurisdictions,” the ECB said in a statement.

The ECB surprised markets Wednesday by holding the unscheduled meeting to discuss a market backdrop that’s deteriorated markedly since plans to start lifting borrowing costs from record lows were outlined last week.

Investors have been unconvinced that officials can raise borrowing costs to combat unprecedented euro-zone inflation while also keeping yields among the bloc’s most indebted members in check. A possible 75 basis-point rate increase from the Federal Reserve later in the day could add to the jitters.

©2022 Bloomberg L.P.