Mar 6, 2021

ECB Confronts Shifting Markets as Economy Stays Frozen: Eco Week

, Bloomberg News

(Bloomberg) -- European Central Bank officials will set policy this week against a backdrop of investors betting on a global upturn even as the euro zone remains mired in pandemic lockdowns and painfully slow vaccinations.

President Christine Lagarde will need to test her institution’s current stimulus plans against the challenges presented by those contrasting situations. While some of her colleagues have signaled concern over rising global bond yields, driven partly by the faster vaccine drive and bigger stimulus plans of the U.S., others are taking it in their stride for now. Investors will be watching Monday’s bond-buying data to see if the ECB ramped up purchases last week.

Meanwhile the ECB will assess the damage to growth from another lost quarter, with lockdowns throughout the euro region freezing activity as health authorities’ immunization efforts struggle to gain traction compared with the U.K. and U.S. Along with the decision on Thursday, Lagarde will unveil new quarterly forecasts at a press conference.

Where the Frankfurt institution can take some comfort is that it already has extensive stimulus in place. The centerpiece of that is its pandemic purchase program, whose original aim was to keep yields in check. That’s currently set to last at least another year.

But sooner or later, as officials observe how a recovery takes shape, they are going to have to decide whether the support currently pledged with that tool is enough.

What Bloomberg Economics Says:

“The ECB has emphasized its intention to maintain favorable financing conditions in an effort to support the recovery. We anticipate a clear message from the Governing Council that higher bond yields are triggering an unwarranted tightening of conditions.”

--Maeva Cousin, David Powell and Jamie Rush. For full preview, click here.

Elsewhere, Canada, Serbia and Kazakhstan are among countries with interest-rate decisions, the OECD presents its latest economic forecasts, and the U.K. will release data that may show the initial impact of post-Brexit trading.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

U.S. and Canada

Investors in the U.S. are watching for the latest consumer price data Wednesday as debate heats up over fears of inflation rising in pockets of the economy. Other reports due out this week include updates on the federal budget, weekly jobless claims and consumer sentiment. Federal Reserve policy makers are in blackout ahead of the central bank’s next meeting on March 16-17.

President Joe Biden’s signature $1.9 trillion Covid-19 relief bill passed the Senate on Saturday, following a more than 25-hour marathon of amendment votes that was completed only after a lengthy interruption while Democrats settled an intra-party dispute over unemployment aid. The measure, the American Rescue Plan Act, now heads back to the House, where Majority Leader Steny Hoyer said a vote will be held Tuesday.

Bank of Canada policy makers meeting Wednesday are likely to indicate they have no plans to withdraw stimulus from the economy any time soon, even as they prepare to adjust their quantitative easing program.

- For more, read Bloomberg Economics’ full Week Ahead for the U.S.

Europe, Middle East, Africa

A turning point in the U.K.’s pandemic response is due on Monday, when schools in England reopen. The measure is an initial step unveiled as part of Prime Minister Boris Johnson’s plan to unlock the economy as vaccinations roll out.

Britain’s other pressing economic challenge, its exit from the European Union, may feature in gross domestic product for January. That report on Friday will reveal a glimpse of the growth impact from the country’s new trading relationship with the bloc as of the start of this year, in addition to the third lockdown.

The U.K.’s two most senior economic policy makers will also speak, with Bank of England Governor Andrew Bailey delivering a speech, and Chancellor of the Exchequer Rishi Sunak testifying to Parliament’s Treasury Committee about last week’s budget.

In the euro region, policy makers will be bound to a quiet period before the ECB decision later in the week. German industrial production data for January on Monday will signal how the factory base there is weathering the global slump and a continuing lockdown.

Elsewhere on the European continent, Serbia’s central bank will release its latest policy decision on Thursday, showing whether officials will keep the interest rate on hold at 1% for a third month after a surprise cut to that level in December.

Data on Tuesday will probably show the South African economy still contracted from a year earlier in the three months through December, even as it’s expected to reflect strong quarter-on-quarter annualized expansion. Israel will move into the next stage of reopening its economy from lockdown restrictions, with restaurants and cafes that will be allowed to open for full service in the world’s most vaccinated country.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Asia

Chinese trade data released Sunday, inflation numbers on Wednesday and credit figures for February will all be closely watched after PMIs pointed to slowing momentum for the world’s No. 2 economy.

Bank of Japan Deputy Governor Masayoshi Amamiya speaks on Monday ahead of a policy review later this month. The words of one of the principal architects of yield-curve control will be closely scrutinized for possible signaling from the central bank of what is in the pipeline.

A raft of data including household spending, wages and bankruptcies will show how the Japanese economy was faring during the state of emergency, while revised GDP figures for the last quarter may show slightly slower growth after the release of weaker capital spending data last week.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Latin America

In Chile on Monday, look for year-on-year inflation data to come in right around the 3% target, where expectations appear well-anchored, yet again.

On Tuesday, Mexico’s inflation reports are the next-to-last price readings before the central bank’s March 25 meeting. The figures here may keep a quarter-point interest rate cut in play.

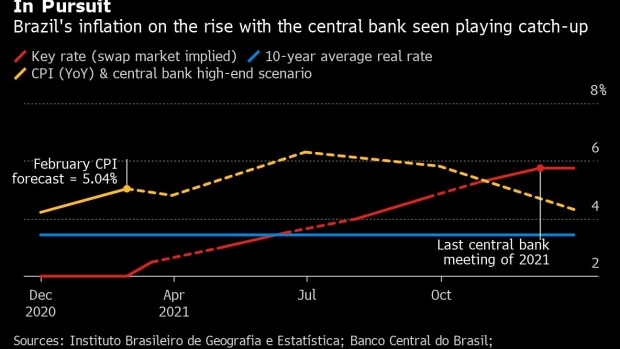

In Brazil events have overtaken policy, with the February report out Thursday expected to show inflation bumping up against the top of target range. Economists see a strong likelihood of a half-point interest rate increase at next week’s central bank meeting while swap traders have priced that in with six more to follow by year-end.

Later in the day, Argentina’s statistics agency posts consumer price data, and Peru’s central bank is expected to keep the key rate unchanged at 0.25%.

The week concludes with January reports on Brazilian retail sales and Mexico’s industrial production.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

©2021 Bloomberg L.P.