Sep 9, 2020

ECB Confronts Weaker Economy, Stronger Euro: Decision Day Guide

, Bloomberg News

(Bloomberg) -- European Central Bank President Christine Lagarde will have to walk a fine line on Thursday as she portrays a euro-area economy that’s recovering as hoped from the coronavirus pandemic yet still in need of massive support.

While new economic projections will confirm that the worst downside risks haven’t materialized, they’ll still be bleak and subject to high uncertainty. Lagarde also now has to deal with a stronger euro that could hamper the upturn.

Read more: ECB Forecasts Said to Show More Confidence in Economic Outlook

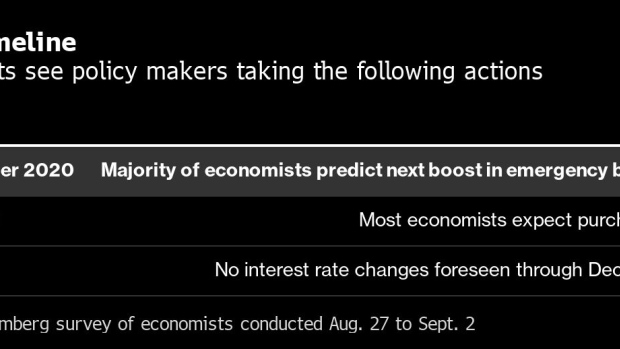

The Governing Council is expected to keep its 1.35 trillion euro ($1.6 trillion) emergency bond-buying program and record-low interest rates unchanged for now. But the president will be quizzed in her press conferences on market expectations for more stimulus later this year.

More Stimulus

The pandemic emergency bond-buying program is set to run until the middle of next year and economists predict another 350 billion euros will be added by December. They also expect purchases to be extended by another six months.

Among policy makers, different views on the direction of stimulus have emerged over the past weeks. Bundesbank President Jens Weidmann is campaigning to withdraw emergency support once the recovery from the pandemic is complete. The program is “limited in duration and clearly linked to the crisis,” he said.

Chief Economist Philip Lane has stressed the ECB is ready to do more if needed, and argued that once the economy has overcome its immediate shock, fueling inflation will become the next priority. The institution is buying an additional 20 billion euros a month in bonds as parts of its quantitative easing tool that was restarted last year.

What Our Economists Say:

“The Governing Council may indicate next week that downside risks have intensified, signaling monetary policy could be loosened further before the end of the year.”

--David Powell and Maeva Cousin. Read the ECB PREVIEW

Euro Strength

The ECB’s job is being complicated by a strengthening euro that risks damping already feeble inflation by making imports cheaper. The currency broke through $1.20 last week for the first time since 2018, before Lane knocked it back saying the exchange rate “does matter” for monetary policy.

Lagarde may try to reiterate this view, but the ECB’s scope for action is fairly limited. Its deposit rate is at -0.5% and has been negative for more than six years, leading to complaints from banks and savers.

Nomura strategist Jordan Rochester said while attempts to talk down the exchange rate should help in the short term, it’ll be difficult to break the euro’s upward trend.

Outlook Update

Some policy makers have become more confident in their forecasts for the region’s economic recovery, according to people familiar with the debate. The latest projections for output and inflation will show only slight changes to the June outlook, with GDP for this year set to be revised up.

That perspective meshes with economists’ views. Most predict growth forecasts beyond 2020 will be largely untouched, as cheaper oil prices help offset the currency’s effect on export demand.

Strategy Reviews

Another topic Lagarde is likely to be asked about is the Federal Reserve’s new framework, which allows the central bank to tolerate faster inflation after periods of weakness. If that keeps U.S. monetary policy loose for longer, pressure on the ECB to do the same could increase to keep the currency in check.

The ECB is in the process of overhauling its own strategy -- for the first since 2003 -- although results aren’t due until the middle of next year.

“It’s a good thing to have a strategy review of monetary policy,” Governing Council member Francois Villeroy de Galhau said in response to the Fed’s decision. “You can be reassured that a credible and symmetrical inflation objective will remain at the heart of our action.”

©2020 Bloomberg L.P.