Jan 30, 2023

ECB Debate Looks to March With Half-Point Hike Assured This Week

, Bloomberg News

(Bloomberg) -- The European Central Bank’s first interest-rate decision of 2023 is just days away, but the focus has already shifted to what will happen beyond that.

A half-point hike is all but guaranteed on Thursday after President Christine Lagarde and many of her colleagues doubled down on a pledge from their last gathering in December.

The real news will be whether they firm up tentative plans to repeat that move in March or open the door to a smaller increase.

There remains a compelling case to forge ahead with what’s already the most intense period of monetary tightening in the ECB’s history. While inflation is receding, it’s nearer double digits than the 2% target. Underlying price gains, meanwhile, are gathering steam.

But with European energy costs plunging, the Federal Reserve considering a slower rate increase on Wednesday and the Bank of Canada pausing its tightening drive, doubts may yet creep in. Some on the 26-member Governing Council are already pondering a downshift.

“We’ll listen very closely to what’s said about future rate moves, if they’re as hawkish or even more hawkish compared to December — or if the tone softens a little,” said Felix Huefner, an economist at UBS. He sees half-point steps in February and March, and maybe another in May.

After halting forward guidance last summer, the ECB insists all decisions are taken meeting-by-meeting and depending on data. That didn’t stop Lagarde from promising February’s 50 basis-point move and maybe an identical one the following month.

Her colleagues have also spoken out — pointing to likely divisions beyond the next meeting.

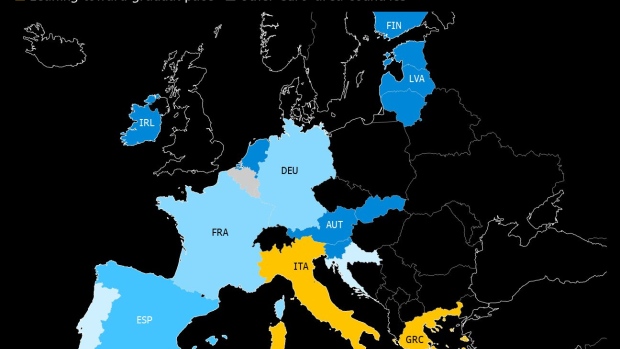

On one side, Bundesbank President Joachim Nagel and France’s Francois Villeroy de Galhau have signaled support for two half-point steps, as have policymakers from Austria, Slovenia, Slovakia, Finland, Ireland and the Baltics.

Top hawks like Dutch central bank chief Klaas Knot don’t see room to slow down before mid-year.

At the other end of the spectrum, Italy’s Ignazio Visco questions whether “it’s better to risk tightening too much instead of too little,” while Greece’s Yannis Stournaras also urges more gradual steps.

Assessing which group will prevail is complicated by a rapidly changing outlook. New quarterly forecasts in March may add some clarity — both on inflation and the chances the 20-nation euro zone can dodge a recession.

“Clear communication will be the key challenge over the coming months,” said Anatoli Annenkov, a senior economist at Societe Generale. “As headline inflation eases, it will be important to stress that a restrictive policy will need to remain in place until core inflation is safely on target.”

January inflation data are due this week, though they’ll be distorted by statistical factors and government interventions to soften the blow of rising heating and power bills. In Spain, consumer-price growth surprisingly accelerated at the start of the year, data Monday showed.

March will likely see Europe’s outlook for consumer prices downgraded, however, following a mild winter and with natural gas storage well stocked — emboldening advocates of a softer policy path.

Read more: ECB Rate-Hike Week May Feature Slowing Inflation, Stalling GDP

Traders, too, aren’t as confident that this week’s half-point hike will be matched the following month, though that’s their most likely outcome. They boosted rate-hike wagers after Spain’s inflation data, pricing the deposit rate peaking above 3.50% by mid-year.

Lagarde has previously indicated she isn’t happy with market expectations and may push back during Thursday’s news conference.

The yield on two-year German notes — among the most sensitive to monetary-policy changes — traded about 2.75% in December for the first time since 2008, before retreating to about 2.65%.

Further details this week on plans to shrink the ECB’s €5 trillion ($5.4 trillion) bond portfolio from March are unlikely to alter perceptions.

What Bloomberg Economics Says

“We expect the ECB to take the deposit rate to 3.25% before a long pause to evaluate the impact of past tightening — higher risk-free rates are a long way from being fully-reflected in borrowing costs faced by households and businesses.”

— Jamie Rush and Maeva Cousin. Click here for full preview

An improved outlook for Europe’s economy may prove more convincing, offering cover for hawks to push for further significant hikes. Even with output shrinking 0.2% in the final three months of the year, according to data on Monday, Germany is set to defy fears of a deep slump and the government is forecasting growth for the whole of 2023.

Before this week’s meeting, most Governing Council members had rallied behind Lagarde, who vowed at the World Economic Forum in Davos that the ECB will “stay the course.”

The biggest challenge for the ECB this week will be to come up with a common language that holds longer than a few days, according to Carsten Brzeski, ING’s head of macro research.

“Lagarde needs to find a better and more clear-cut communication on what the exact reaction function of the ECB is,” he said. “What are the triggers for stopping rate hikes? Headline inflation, core inflation, inflation expectations, wage developments?”

Getting out a clear message may indeed prove tricky amid so many opposing views. With all the rate preferences flying around, dovish Executive Board member Fabio Panetta reckons it’s best to wait for all necessary data before offering up predictions.

“Our December decisions were based on the projections available at that time,” he said last week. “In March, we’ll have new ones and should reassess the situation.”

--With assistance from Greg Ritchie and Harumi Ichikura.

(Updates with Spanish inflation, German GDP starting in 14th paragraph.)

©2023 Bloomberg L.P.