Apr 8, 2022

ECB Is Crafting Crisis Tool to Deploy If Bond Yields Jump

, Bloomberg News

(Bloomberg) -- The European Central Bank is working on a crisis tool to deploy in the event of a blowout in the bond yields of weaker euro-zone economies, according to officials familiar with the plans.

The institution’s staff is designing a backstop that would be available for the Governing Council to use against debt-market stress caused by shocks outside the control of individual governments, said the officials, who asked not to be identified because the matter is confidential.

It’s not clear what the tool would look like, though such an instrument would presumably involve bond purchases in some form to contain yields.

While the ECB’s next interest-rate decision is less than a week away, there’s no indication that a measure is about to be unveiled imminently. Policy makers haven’t decided whether to ultimately publicize a stand-by tool or keep it under wraps unless it’s needed, the officials said.

An ECB spokesperson declined to comment on the institution’s contingency planning.

Italian bonds pared an earlier decline after the news was reported. The yield on 10-year Italian debt traded around 2.35% compared to around 2.40% previously.

The ECB’s behind-the-scenes preparations hint at how officials are bracing for the moment when bond markets will need to cope without large-scale interventions for the first time after more than seven years of nearly uninterrupted asset purchases.

Policy makers stopped emergency bond-buying last month and aim to halt regular quantitative easing in the third quarter.

The creation of a new crisis tool against a relatively benign market backdrop might mark a rare moment of the ECB getting ahead of the game rather than catching up under duress. By contrast, former President Mario Draghi’s OMT measure in 2012 and the Pandemic Emergency Purchase Program in 2020 were unveiled after financial turmoil had engulfed the region.

Already last year, policy makers discussed a precautionary instrument to prepare for so-called fragmentation risks, with officials from the region’s periphery lobbying for an unconditional purchase backstop, while peers from core countries insisted on some strings attached.

The debate was resolved when the Governing Council deemed in December that extra flexibility in reinvesting bonds maturing from its emergency portfolio would be sufficient. But the imminent end of QE and heightened uncertainty about the implications of Russia’s war in Ukraine has reignited concerns among some policy makers.

No Trouble

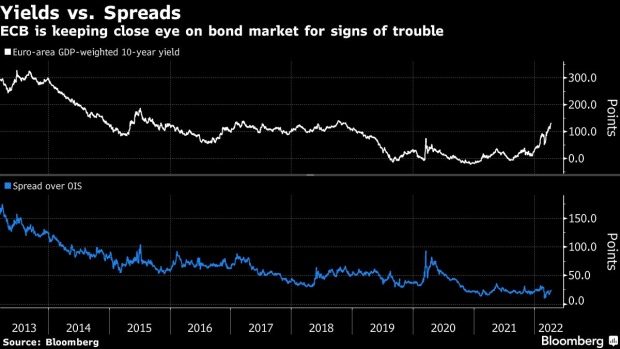

For now, the bond market is signaling next to no signs of trouble. While yields across the region have risen steeply and are at the highest level since 2018, spreads have barely budged. That’s a sign that higher rates reflect strong economic rebounds from the pandemic rather than concern about the sustainability of national debts.

The coronavirus crisis in 2020 has showed how quickly things can change however. The ECB was forced to create its PEPP backstop within days. The measure eventually grew to 1.7 trillion euros ($1.8 trillion) to counter “serious risks” to the transmission mechanism of monetary policy and the economic outlook.

Officials including Chief Economist Philip Lane have hinted that the possibility of further moments of turmoil is on their minds. He argued on March 2 that “self-fulfilling cross-border flight-to-safety episodes” are an inherent risk.

“The ECB has demonstrated its capacity to design flexible instruments in reaction to stressed conditions” in the past, he said, and will “consider, as needed, new policy instruments in the pursuit of its price-stability objective.”

President Christine Lagarde made similar remarks on March 17. Meanwhile Bank of France Governor Francois Villeroy de Galhau had previously called for the ECB to have a “virtual toolbox” available for future turmoil, drawing on measures deployed during the coronavirus crisis.

A decision that awaits ECB officials is whether to stick with the use of public rhetoric to stop speculation against euro members such as Italy, or whether to follow Draghi’s example of presenting an actual tool to combat it.

His signature OMT program was officially presented in September 2012, six weeks after his famous pledge to do “whatever it takes,” and another six weeks after policy makers started exploring tools to respond to the market stress at the time. The program has never been activated and its existence was enough to ultimately stem turmoil.

(Updates with market reaction in sixth paragraph)

©2022 Bloomberg L.P.