Mar 20, 2023

ECB Isn’t Done on Rate Hikes If Baseline Holds Up, Kazaks Says

, Bloomberg News

(Bloomberg) -- The European Central Bank must fight inflation until the job is done, while acknowledging the rising risk of pushing interest rates too high as the peak nears, Governing Council member Martins Kazaks said.

Price pressures remain too strong and warrant further action — assuming the market turmoil that saw off Silicon Valley Bank and rocked Credit Suisse Group AG doesn’t worsen to derail Europe’s economy, Kazaks said Friday in an interview.

At the same time, after 350 basis points of hikes since July, officials must carefully weigh the implications of future moves, he said.

“Inflation is still very high — rates, in my view, needed to go up,” he said. “And if the baseline scenario holds and market volatility calms down and does not derail the scenario, then with the current macro outlook and the outlook for inflation, more interest-rate increases will be necessary.”

Still, “we’re getting closer to the situation where we very cautiously have to address both risks — of doing too much and doing too little — in terms of implications for the economy,” said Kazaks, the hawkish head of Latvia’s central bank.

Despite the global panic over banks, the ECB last week delivered the half-point rate increase it had been flagging since February. At the same time, the turbulence prompted policymakers to abandon their practice of signaling the path ahead for borrowing costs.

“Providing very clear guidance over multiple meetings currently is not only inappropriate, but also counterproductive,” Kazaks said. “But of course, forward guidance is as good an instrument as any, and if we will see it necessary and the environment is going to be appropriate, we may use it again.”

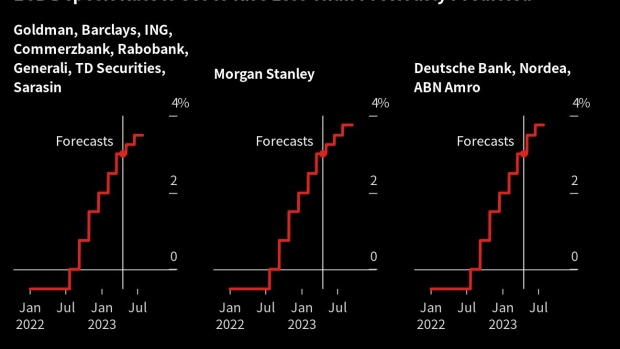

After pricing a peak in the deposit rate — currently 3% — of more than 4%, traders are now betting it will ultimately settle at 3.10%. Many economists have also lowered their predictions.

Kazaks wouldn’t specify where he sees the so-called terminal rate.

“As long as we are within the baseline scenario, staying the course is important because at the end of the day high inflation is very damaging to the economy and especially to those with lower incomes,” he said. “So we need to resolve this in a reasonable timespan without delaying too much.”

If turmoil on financial markets results in more cautious bank lending, “then the economy is going to be weaker and that of course may lead to a situation where the rates may not need to go up that much,” Kazaks said.

While the ECB’s new projections showed inflation, including a gauge that strips out energy and food, closer to the 2% target by 2025, Kazaks still sees risks skewed to the upside.

The economy is proving stronger than expected, the robust labor market is unlikely to shift and wage pressures are building, he said, highlighting wide corporate profit margins that show businesses passing on higher costs.

Finding the precise policy trajectory will probably involve “some trial and error,” Kazaks said.

Yet “the consequences of raising by 25 basis points too much are easier to repair than consequences of raising by 25 basis points too little,” he said. “You can always cut rates if necessary, but if you want to cover for the earlier shortfall, it is very likely that you would need to raise by much more than 25.”

Kazaks echoed comments by President Christine Lagarde, stressing that the ECB is well placed to respond if market ructions spill over into the euro zone.

“It’s quite likely that some financial institutions will have made wrong bets,” he said. “There are always going to be weak links here or there, so something is likely to happen,” but “we have the tools, we have the instruments, and if it will be necessary, we will devise appropriate new ones.”

--With assistance from Constantine Courcoulas and James Hirai.

©2023 Bloomberg L.P.