Oct 16, 2019

ECB Members Seek New Ways as Draghi Inflation Record Disappoints

, Bloomberg News

(Bloomberg) -- European Central Bank policy makers urged governments and their own institution to consider changing strategy after years of monetary stimulus combined with fiscal restraint left the euro zone still stuck with feeble growth and inflation.

The calls in speeches and a newspaper interview, a week before ECB President Mario Draghi holds the final monetary-policy meeting of his eight-year term, ranged from greater public spending to a review of the European Union’s two-decade old pact to rein in government debt and deficits. They come amid an extended squabble over last month’s decision to cut interest rates and buy bonds yet again, a step that has raised concerns the central bank is running out of options.

“Our assessment is that we’re not at the edge, but of course we’re closer to the edge than we were,” chief economist Philip Lane said in Washington on Wednesday, where the International Monetary Fund is holding its annual meetings. “If there were fiscal expansion in these current conditions, the multiplier will be quite big. This goes back to finance ministers thinking about fiscal policy as a macro tool.”

The ECB has long called for governments that can afford it, notably Germany, to join the effort to revive the euro-zone economy by raising spending. For just as long, it has essentially been ignored -- Germany, the bloc’s largest economy, has continued to run a budget surplus and pledged to balance its books despite probably now being in recession.

That may be about to change as politicians face the risk of a global downturn amid the uncertainties of U.S. President Donald Trump’s trade protectionism and the U.K.’s exit from the EU. German lawmakers who have previously resisted the idea of fiscal stimulus are starting to come around, according to people familiar with the discussions.

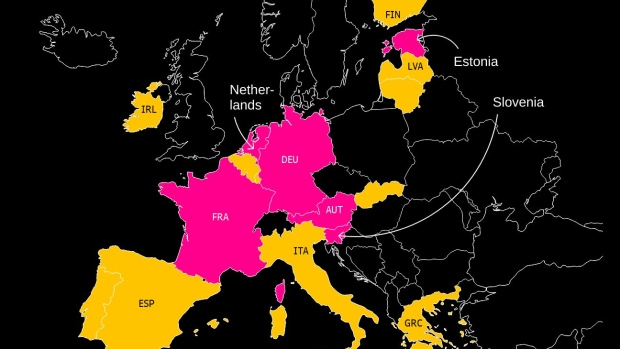

For Dutch governor Klaas Knot, who opposed the resumption of quantitative easing at September’s policy meeting, a wider initiative is needed. He said the next step must be an overhaul of both ECB and EU economic strategy.

“Not only has inflation been subject to a downward trend, but also its inertia has increased since the crisis,” he said in New York. “I support calls for a broad review of the ECB’s strategy, which should have as one of its main aims the widening of our policy scope.”

Knot said the ECB could increase its flexibility by introducing a symmetric band around the inflation aim, currently set at just below 2%. Governments could simplify the Stability and Growth Pact to put more emphasis on debt levels relative to budget deficits.

Austrian Governor Robert Holzmann, another opponent of the most-recent monetary measures, weighed in with an interview in German newspaper Handelsblatt, in which he said he sees no sign that negative interest rates are boosting consumption or investment.

He also suggested that one of the main tasks of Draghi’s successor from Nov. 1, Christine Lagarde, will be to restore harmony in the decision-making Governing Council.

“I expect that Lagarde will start a process in the ECB that more-strongly integrates national central banks,” he was quoted as saying.

--With assistance from Yuko Takeo.

To contact the reporters on this story: Piotr Skolimowski in Frankfurt at pskolimowski@bloomberg.net;Jill Ward in London at jward98@bloomberg.net

To contact the editors responsible for this story: Paul Gordon at pgordon6@bloomberg.net, Jana Randow

©2019 Bloomberg L.P.