Mar 9, 2021

ECB’s Bond-Buying Restraint Rings Alarm for Citi, Commerzbank

, Bloomberg News

(Bloomberg) -- After two weeks of muted debt purchases by the European Central Bank in the face of a global bond selloff, some strategists are starting to get worried.

Data on Monday showed the ECB settled 11.9 billion euros ($14.2 billion) of net buying under its Pandemic Emergency Purchase Program last week, even when yields on German debt rose to levels last seen since the outbreak of the pandemic. The amount follows a similar size of purchases in the prior week, well below the average purchase pace of 18 billion euros since the tool’s inception.

While the ECB said the latest numbers were pushed down by unusually large redemptions of maturing debt, it could have countered that by stepping up gross purchases. Yet it only opted for a relatively mild increase, according to a breakdown published Tuesday.

Strategists from Citigroup Inc. and Commerzbank AG are becoming concerned that the combination of a glut of issuance and tepid ECB bond-buying could inflict pain on some of the most vulnerable corners of the European bond market.

“Longer-term, the real cost of any inaction is the credibility of the policy framework,” Citigroup rates strategist Jamie Searle wrote in a note on Tuesday. “Investors may think twice about buying record issuance if the ECB allows confusion about its aims to fester.”

Too Divided?

Most economists in a Bloomberg survey expect the ECB will step up its asset purchase pace when it announces monetary policy on Thursday. A majority also predicted the 1.85 trillion-euro program will ultimately be extended beyond its current end-date of March 2022.

That comes as governments in the region aim to sell over a trillion euros of debt this year to fund their spending pledges, on par with last year’s record levels. That’s in addition to the European Union’s target of 100 billion euros of SURE social bonds, ahead of financing for its 800 billion-euro pandemic recovery fund this summer.

The ECB may be too divided to deliver a decisive response, and that could raise regional yield premiums over Germany’s benchmark peers, Citigroup’s Searle said.

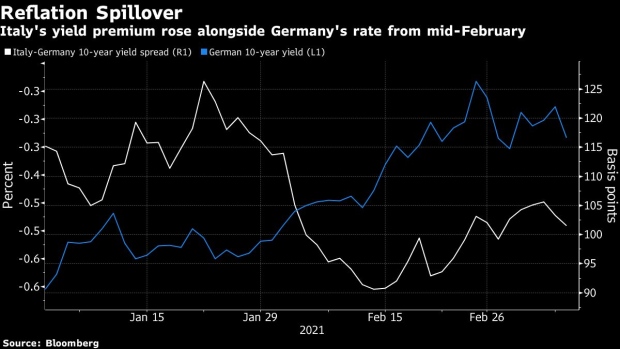

Italy’s 10-year yield premium over its German peer -- a key gauge of risk in the region-- rose 30 basis points from a six-year low to 109 basis points last week.

Meanwhile, Commerzbank AG strategists Christoph Rieger and Cem Keltek are worried about Europe’s longer-maturity debt.

“The numbers still don’t suggest that the ECB is aggressively leaning against U.S. spillovers into Europe’s long end,” Rieger said after today’s data. “The ECB seems to be quite anxious about its data sending the wrong signals.”

Germany’s 30-year yield premium over its 5-year counterpart rose to 60 basis points on Friday, the highest since January last year.

©2021 Bloomberg L.P.