Mar 29, 2023

ECB’s Lane Says More Hikes Needed If Bank Stress Stays Contained

, Bloomberg News

(Bloomberg) -- The European Central Bank will need to increase interest rates further if recent tensions in the financial system stays contained, Chief Economist Philip Lane told Zeit in an interview.

Under the ECB’s baseline scenario, “we expect these tensions will settle down” and then “more hikes will be needed,” Lane said.

“If the financial stress we see is non-zero, but turns out to be still fairly limited, interest rates will still need to go up,” he told the German weekly newspaper. “However, if the financial stress we talked about becomes stronger, then we’ll have to see what’s appropriate.”

The comments provide a new glimpse on the evolution of the ECB’s thinking on how to navigate the combination of both global finance anxiety and a festering inflation shock.

The ECB hiked rates by a half point this month, though — faced with a banking crisis in the US and Switzerland — it held off on giving guidance on its next move. With turmoil subsiding, several hawkish policymakers have become more outspoken to resume calls for further tightening.

Speaking earlier Wednesday, Slovakia’s Peter Kazimir said the ECB should push on with rate increases despite the strains around the financial industry, though the pace of hikes may need to slow. He warned that there’s a “real risk” of banks curbing lending.

There’s “no direct read-across” to the euro area from the turbulence, Lane said. “In the baseline, we expect these tensions will settle down.”

He also underscored recent comments by other central bankers that the ECB’s doesn’t face a trade-off between protecting financial stability and controlling inflation.

“If this financial stress weakens the economy, it would automatically reduce the inflationary pressures,” Lane said.

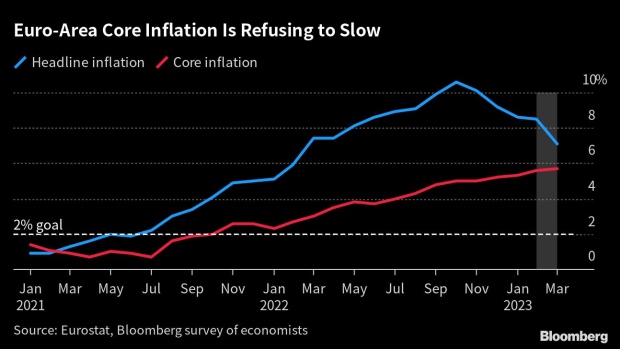

Euro-area inflation data due Friday are likely to show a drop in headline inflation, though the underlying reading, which excludes energy and food, is predicted to hit a new euro-era record.

Further comments by Lane:

- “Of course we’re closely monitoring developments and are on our guard, but we don’t expect to see the same situation as in the US or in Switzerland to be the most likely scenario here in the euro area”

- “We have many tools, we can provide liquidity, and we can make sure we don’t see the types of bank runs that were evident in these examples”

- “We’re seeing wage increases that are higher than normal, but in the grand scheme of things they look reasonably fair. But we have to keep an eye on this”

- “Firms will have less space to increase their profits through higher prices. For many reasons: demand should cool off and the supply bottlenecks should ease, for example. So the share of the burden changes over time”

(Updates with ECB’s Kazimir in sixth paragraph.)

©2023 Bloomberg L.P.