Jun 7, 2023

ECB’s Makhlouf Warns of Risks in Commercial Property Markets

, Bloomberg News

(Bloomberg) -- Commercial real estate markets are “particularly vulnerable” to a rapid tightening of global monetary policy, the Central Bank of Ireland warned.

Sustained growth in commercial real estate investment globally in recent years has led to “concerns about stretched valuations” in the sector, the bank said Wednesday in its latest financial stability review. The sector is now facing both cyclical headwinds from rising interest rates as well as structural challenges due to work-from-home practices following the Covid-19 pandemic, the regulator added.

Higher financing costs have “already had immediate effects in the commercial real estate market” while also appearing to “slow” the housing market over recent months, Central Bank of Ireland Governor Gabriel Makhlouf said.

With valuations still stretched in many countries, “there is a risk of sharp price correction” in residential real estate markets if interest rates rise by more than currently expected, the bank said.

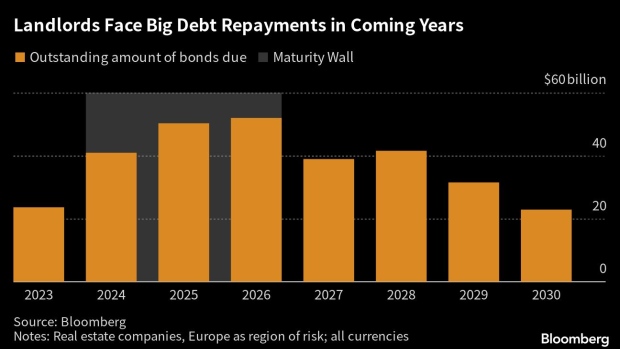

The warning is the latest sign of increased scrutiny of real estate markets. Many property companies took on massive debt to fuel expansion and face higher costs and tighter funding as they seek to refinance. In Europe, Sweden has been at the epicenter of an unfolding crisis.

Ireland’s commercial property market has shown signs of stress over recent months with a significant reduction in investment volumes late last year as higher interest rates and inflation added to investor hesitancy.

The central bank said a weakening global outlook, tighter financing conditions and international developments — such as the ongoing debt crisis in China’s property sector — could trigger a “further retrenchment of international real estate investment activity.”

Read More: A New Wave of Real Estate Pain Is Coming After European Rout

Corrections in commercial property markets could also be “amplified” by forced sales due to covenant breaches by landlords or large redemption requests from real estate investment funds, the bank added.

Irish Life Assurance Plc blocked withdrawals from its €500 million Irish property fund for a six-month period in March, joining other investment managers with similar restrictions on withdrawing money.

The Irish central bank last year announced a 60% leverage limit for property funds and issued guidance aimed at reducing liquidity mismatches. The leverage rules are being phased in gradually over five years until 2027 while funds have been told to take “appropriate actions” within 18 months to implement the liquidity guidance.

The bank is continuing to work with other regulators to tighten international rules on the non-bank sector, having lobbied partners on the matter previously.

©2023 Bloomberg L.P.