Mar 29, 2023

ECB’s Schnabel Says Eurozone Banks Haven’t Seen Deposit Outflows

, Bloomberg News

(Bloomberg) -- European Central Bank Executive Board member Isabel Schnabel said that eurozone banks have not seen a loss of deposits despite the recent financial stability concerns.

“We’ve seen some shift from overnight deposits into time deposits, but we’ve not seen a general deposit outflow of the banks,” she said Tuesday at an event in Washington. “For now the banking sector looks rather resilient.”

While the eurozone will likely feel less real-economy effects from recent financial market turmoil than the US, the region could still see some tightening of credit conditions.

“Directionally it is very clear this would have a disinflationary effect that we would need to take into account,” she said. “I think it is completely open for now how big that effect” will be.

The ECB raised interest rates by half a point earlier this month, defying financial-market turmoil following the collapse of Silicon Valley Bank in the US and trouble at Credit Suisse Group AG. While policymakers refrained from committing to additional hikes, they’ve argued that inflation remains much too high and warrants further action unless the outlook changes.

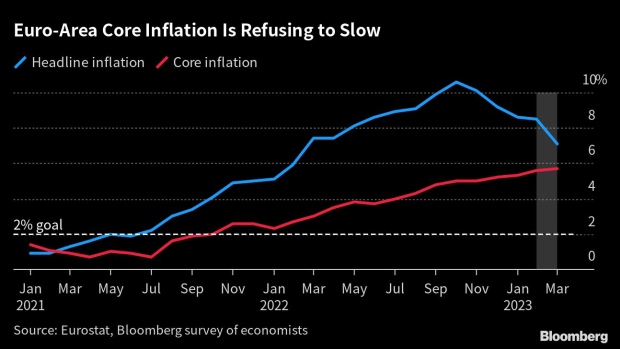

The latest ECB projections, compiled before market tensions erupted, see price pressures slowing to 2% in the second half of 2025. Data for this month are due on Friday, and economists surveyed by Bloomberg predict the rate falling to 7.1%, the lowest in just over a year.

At the same time, underlying inflation is refusing to budge as last year’s surge in energy works its way through the economy. That’s keeping officials alert on any signs that a wage-price spiral might take off.

For now, they argue, the risks are contained even as trade unions in Germany and other countries in the 20-nation bloc are winning double-digit pay increases to make up for the loss in purchasing power. Consumer expectations for inflation three years ahead have actually declined.

©2023 Bloomberg L.P.