Jun 5, 2023

ECB’s Vujcic Says Inflation Risks Are Still Tilted to Upside

, Bloomberg News

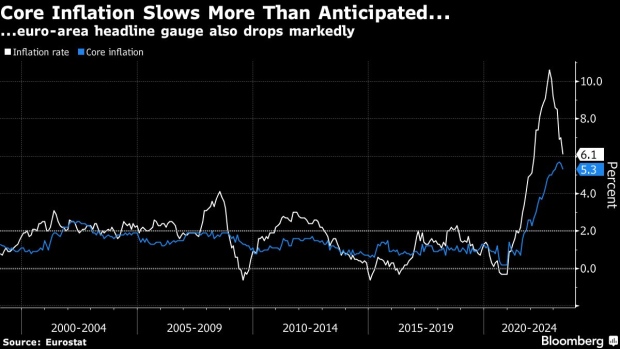

(Bloomberg) -- European Central Bank Governing Council member Boris Vujcic said the surge in consumer prices is only slowly abating, and the dangers of a resurgence exceed those of a more rapid retreat.

“Disinflation is expected to be gradual, with the risks still tilted upward driven by risks coming from the tight labor market and underlying price pressures in the services sector,” the Croatian central bank chief told Bloomberg Saturday in Dubrovnik.

Vujcic spoke just under two weeks before the ECB next sets borrowing costs, with investors and economists widely expecting another quarter-point increase in the deposit rate to 3.5%.

It’s unclear whether the spate of hikes will end at the following meeting, in July, or persist into the next one, in September. Salary developments will play a big role in shaping the monetary-policy path.

While Vujcic sees wage pressures in the 20-nation euro zone as smaller, on average, than in his homeland, he said: they’re “still very lively, and we still need to see where it will stop.”

©2023 Bloomberg L.P.