Jun 10, 2021

ECB Said to Differ on Bond-Buying Needs in Thin Summer Market

, Bloomberg News

(Bloomberg) -- European Central Bank policy makers differed in their Thursday meeting over how much bond-buying would be needed when liquidity in financial markets is thinner during the summer, according to officials familiar with the debate.

The Governing Council session also saw some members raise the prospect of upside risks to inflation in the euro zone, the officials said. The people asked not to be identified because the meeting was private.

On Thursday, the Governing Council decided that emergency bond-buying would continue at a “significantly higher pace” than the 14 billion euros ($17 billion) a week at the start of the year -- despite substantial upward revisions to the economic outlook.

President Christine Lagarde flagged that there were differences of opinion during her press conference.

“There was debate on the pace of purchase, on some of the analytical aspects on the use of our instruments. So I use the words broadly agreed. There was here and there a couple of diverging views and not unanimous consent across the board.”

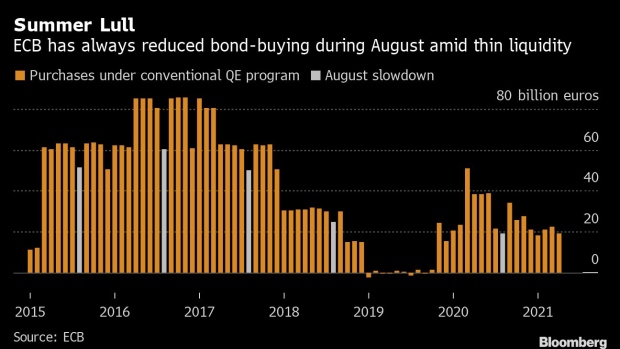

The discussion over liquidity was left unresolved. Some argued that lower market volumes would allow the ECB to spend less than otherwise needed to keep financing conditions favorable, resulting in fewer purchases in the third quarter than the second. Others who focused on maintaining the current purchase pace wanted to see faster buying in July and September to make up for a weaker August.

The ECB has a habit of slowing bond-buying during August amid concerns that a larger presence would overwhelm the market.

Read more: ECB Compromise on Bond-Buying Might Be Brokered by Summer Lull.

In their discussions on inflation, some members raised the question of whether risks to outlook for price growth could be seen as on the upside, the officials said. That’s partly due to the euro zone’s strong economic recovery and spillovers from the U.S., where inflation has soared.

Lagarde said in her press conference that higher inflation rates will be temporary and underlying price pressures remain subdued.

An ECB spokesman declined to comment.

©2021 Bloomberg L.P.