May 16, 2022

ECB Seen Raising Rates Above Zero This Year as Recession Avoided

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

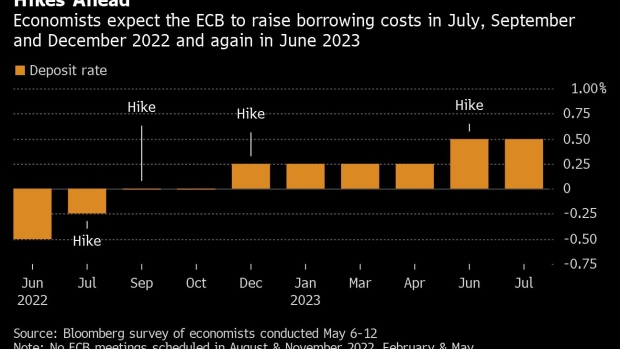

The European Central Bank will raise interest rates three times this year in a bid to quell inflation, according to economists polled by Bloomberg who’re aligning their views with an increased sense of urgency among policy makers.

The Governing Council will lift the deposit rate by a quarter-point in July, September and December, taking it to 0.25% by year-end, the survey showed. The main refinancing operations rate will be hiked in September and December, taking it to 0.5% from zero now.

In an earlier poll, economists had only expected a single quarter-point increase this year, with the shift reflecting growing support inside the ECB for rates to start rising in July and maybe rise back above zero in 2022 following eight years below.

The economy, meanwhile, is predicted to keep expanding this year even as challenges mount because of the war in Ukraine. Growth of 2.8% and 2.3% in 2022 and 2023 is now envisaged -- a downgrade of 0.1 percentage point for each.

While inflation forecasts were raised to 6.7% and 2.6% for this year and next, consumer-price growth is still seen slowing to 1.9%, below the ECB’s target, in 2024.

©2022 Bloomberg L.P.