May 30, 2023

ECB Sounds Warning Over Waning Market Liquidity as Rates Rise

, Bloomberg News

(Bloomberg) -- The euro area’s markets could see “stressed liquidity” due to heightened economic uncertainty, monetary policy normalization and tighter financial conditions, according to the European Central Bank.

In a report released ahead of Wednesday’s financial stability review, the central bank highlighted the region’s market and funding liquidity conditions deteriorating simultaneously since early 2022. This is unusual and indicators suggest market liquidity is now as low as during the onset of the pandemic in early 2020, it said.

The trend comes as central banks reduce the accommodative monetary policy and large bond purchases of recent years that had been supporting the orderly functioning of funding markets despite poorer liquidity conditions, according to the ECB.

“These cyclical factors may have reached a turning point, potentially exposing the underlying risks that have been masked by accommodative policy over the last decade,” Nander de Vette, Benjamin Klaus, Simon Kordel and Andrzej Sowinski wrote in the report. “It signals the heightened risk of a shift toward a stressed liquidity regime.”

Read more: European Lenders Found to Tap Shadow Banks for 14% of Funding

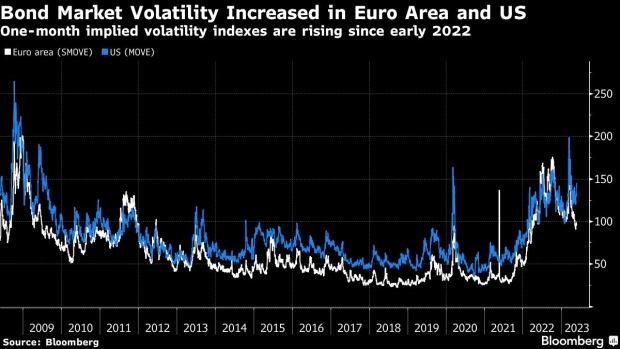

The reduced presence of global central banks in bond markets will further challenge market makers’ willingness to provide liquidity as they have already been struggling with “extremely high bond price volatility,” the authors said. Due to those challenges, the average number of market makers active in the euro-area bond market dropped to the lowest on record around the end of last year, according to the central bank.

One mitigating factor is that euro-area banks have been resilient, with strong capital and liquidity positions, according to the report. However, banks might not be able to adjust the maturity of their liabilities overnight once quantitative tightening is under way, and might face exposure to liquidity claims by non-banks and non-financial corporations.

“Both market liquidity and funding liquidity conditions might be more fragile and flightier than the aggregate measures for liquidity suggest, and they therefore warrant continuous monitoring,” the report said.

©2023 Bloomberg L.P.