Oct 22, 2022

ECB to Cross 2008 Rubicon With Hike Defying Slump Risk: Eco Week

, Bloomberg News

(Bloomberg) -- The European Central Bank in the coming week will tread into territory last visited in the run-up to the global financial crisis as it raises interest rates during what looks likely to be a recession.

It was in July of 2008, just as the euro area began four quarters of contraction, that the Governing Council raised borrowing costs for the first time in more than a year, only to reverse course soon after as the collapse of US investment bank Lehman Brothers inflicted unprecedented market turmoil.

This time, officials are confronting far higher inflation, stoked by risks of a different order as the energy crisis incited by the Russia’s war in Ukraine raises living costs and crushes economic growth.

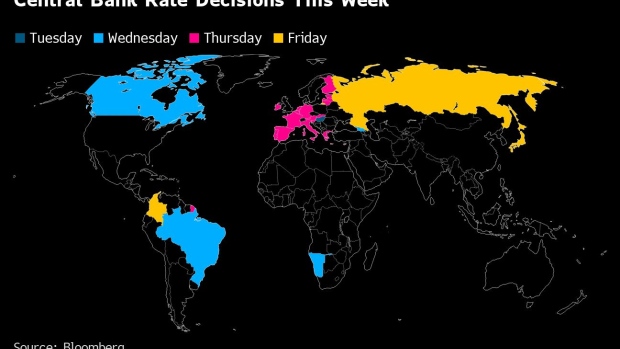

As with central banks from Canada to Colombia that are likely to tighten policy, the ECB’s need to get rates higher to stop consumer prices from getting out of control will keep policy makers focused -- even as the risk of a slump looms closer than ever.

That’s why, even as many economists now reckon a recession has begun in the euro region, they unanimously anticipate another jumbo hike of 75 basis points on Thursday.

Memories of what’s now perceived as a policy mistake in 2008 might yet come to haunt the ECB, especially as rates go even higher and begin to constrict growth in due course. Such a prospect is likely to make future hiking decisions in 2023 more contentious, even if this one won’t be.

What Bloomberg Economics Says:

“The ECB will focus on the extremely high rate of inflation and continue raising interest rates as the economy weakens. We look for another 75-bp hike in October and the deposit rate to end the tightening cycle at 2.25% in February.”

--For full analysis, click here

Elsewhere, gross domestic product reports may show a return to growth in the US, a contraction in Germany, and a slowdown in France. The selection of a new UK prime minister and likely unchanged rate decisions in Japan, Russia and Brazil will be among other highlights.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

US and Canada

The calendar includes the US government’s first estimate of third-quarter growth, as well as September personal consumption, income and inflation figures.

GDP may have expanded at a 2.3% annualized rate during the July-September period after contracting in both the first and second quarters, economists surveyed by Bloomberg project. The Atlanta Fed’s GDPNow estimate puts third-quarter growth at 2.9%.

Details of the report will provide clues about the level of consumer and business demand at a time of heightened inflationary pressures and in the midst of the Fed’s series of huge rate hikes. Among other things, the aggressive policy tightening probably led to a collapse in third-quarter residential investment.

The Atlanta Fed estimates personal consumption grew at a 1.2% pace in the quarter, which would be the slowest advance since the early months of the coronavirus pandemic. Business outlays for equipment are seen bouncing back, though, after a lull in the prior three months.

The September income and spending report on Friday will indicate how much momentum, if any, the economy had entering the fourth quarter. The data are also projected to show a pickup in a key inflation measure watched by Fed officials after a similar metric accelerated to a 40-year high.

Fed policy makers will be in a blackout period ahead of their Nov. 1-2 meeting, at which they’re expected to raise the benchmark lending rate by 75 basis points for a fourth-straight time.

Further north, a faster-than-expected inflation reading has left economists split on how aggressively the Bank of Canada will raise rates on Wednesday. Some are sticking to predictions for a half-point move, while others anticipate a 75 basis-point increase, in line with the expectations of financial markets.

If officials in Ottawa go for the larger option, that would take the benchmark overnight lending rate to 4% for the first time since early 2008.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Asia

China unveiled a new, loyalist-packed leadership team on Sunday as President Xi Jinping consolidatied power for a third term, and investors are watching closely for what that could mean for economic policy. They’re also on watch for the delayed release of China’s third-quarter GDP numbers and September readings on retail sales, investment, industrial production and the ailing housing market.

With Tokyo still keeping a close eye on the yen, the Bank of Japan meets to decide policy. Governor Haruhiko Kuroda insists he’ll stick with rock-bottom rates to stimulate the virtuous form of inflation he’s been seeking for almost a decade, even as markets keep pressure on the currency and the BOJ’s yield cap.

On Tuesday, Australian Treasurer Jim Chalmers unveils a budget update -- his first since the Labor Party’s election victory. The following day, Australia’s latest prices data is set to show headline inflation running at its quickest pace since 1990.

South Korea issues GDP figures on Thursday that are expected to show slowing growth. And in Southeast Asia, Singapore issues its latest inflation print that’s likely to show price gains staying at a 14-year high, while the Philippines central bank will be watched as it seeks to defend the currency against further losses.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

The UK’s ruling Conservative Party will rush through a leadership contest in the coming week in the wake of Liz Truss’s resignation as prime minister following a botched budget that caused untold financial-market turmoil.

Hastily announced rules mean that a result can emerge as soon as Monday -- on the basis that in a narrowed field of two candidates, the one with least support will face pressure to withdraw and get the whole thing over with.

Whoever wins will inherit an economy struggling to shake off long-term decline. A much-awaited fiscal plan may attempt to address that, and events in the coming days will determine whether the proposal will be announced on Oct. 31 as scheduled, or pushed back.

While ECB policy makers focus on their rate decision on Thursday, data on economic growth from around the euro zone will also draw attention.

On Monday, surveys of purchasing managers for October are due, while on Friday, third-quarter GDP will be published in three major countries. Germany’s is likely to show a contraction while the French and Spanish economies probably slowed markedly.

Sweden, which now faces a housing slump as severe as it did during the financial crisis, is likely to have seen GDP shrink in the quarter too. Those data are due the same day.

Also on Friday, Russian policy makers are likely to put easing on hold as inflationary pressures pick up and growing uncertainty surrounding the invasion of Ukraine hurts confidence.

Elsewhere in the region, South African Finance Minister Enoch Godongwana will present his second medium-term budget on Wednesday, with better-than-expected tax collection and higher nominal GDP likely to lead to an improvement in key metrics.

He’ll also provide details of the Treasury’s long-awaited plan to take over a portion of state-owned utility Eskom Holdings SOC Ltd.’s 413 billion rand ($22.8 billion) debt.

On the same day, Namibia’s central bank will probably raise rates by 75 basis points to safeguard its currency peg with the rand and tame inflation.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

A record central bank tightening cycle and slowing growth appear to be finally getting the better of Mexico’s consumer prices, data due on Monday are expected to show. Headline figures have likely peaked, at last, although core readings may have inched up from 8.29%.

In an busy week for Brazil, analysts expect that consumer-price increases slowed for a fifth month through mid-October, with the broadest measure of inflation coming in a bit above 7%.

With that data in hand, the central bank will almost certainly keep its key rate at 13.75% for a second meeting on Wednesday. The bank has signaled its intent hold the benchmark Selic higher for longer. Unemployment and formal job creation figures are also on tap.

On Thursday, the minutes of Banco Central de Chile’s Oct. 12 meeting may offer added guidance after policy makers ended a record hiking cycle at 11.25% and said they’d keep the rate there “as long as necessary.” Chile also reports labor, manufacturing, copper production and retail sales data.

Closing out the week, Colombia’s Banco de la Republica is set to meet with inflation at 11.44% and still rising, the peso near record lows, and the president imploring investors to keep their cash in the country. Analysts look for a 100 basis-point hike to 11% on Friday with further tightening to come.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Robert Jameson, Vince Golle, Benjamin Harvey, Malcolm Scott and Theophilos Argitis.

©2022 Bloomberg L.P.