Nov 25, 2020

ECB Warns European Banks May Need More Bad-Loan Provisions

, Bloomberg News

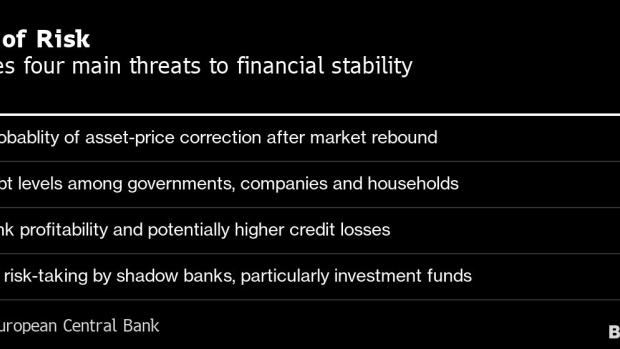

(Bloomberg) -- Euro-area banks will probably have to set aside more money to soak up losses when government pandemic support ends and the economy grapples with massively increased debt, the European Central Bank said.

Provisions for losses on loans to companies are lower than in previous crises and below those seen in the U.S., the ECB said in its Financial Stability Review. That’s partly because measures by European governments and the central bank have reduced default risks, and partly because of weak profitability at banks.

The worry is that once emergency aid is pulled, some companies won’t be able to cover repayments, putting lenders under renewed stress.

“Provisions have increased but look optimistic in some cases,” ECB Vice President Luis de Guindos said in the review. “Guarantees and moratoria may have lengthened the time it takes for weak economic performance to translate into loan losses.”

Euro-area financial stocks declined on Wednesday, with the Euro Stoxx Banks Index dropping 1.5% as of 10:40 am. Frankfurt time, underperforming the broader market.

The ECB also highlighted “stretched” valuations in some asset prices that raises the risk of a sudden drop hitting the financial system. That echoes warnings by the Federal Reserve and the International Monetary Fund this month of the risk to markets if the economic impact of the coronavirus worsens.

Government loan guarantees, debt-repayment holidays and tax deferrals have been key to weathering the biggest peacetime recession in almost a century, allowing companies to keep paying wages and maintain cashflows during enforced lockdowns.

The ECB has enabled that fiscal aid by keeping interest rates low with exceptional monetary stimulus, and plans to step up its actions again in December. It has also given banks regulatory relief, in return telling them to halt dividend payouts at least through the end of this year.

Executive Board member Yves Mersch, the vice-chair of the ECB’s bank-supervision arm, said in an interview with the Financial Times published Wednesday that ending the de facto dividend ban will depend on the “conservatism” of banks’ internal models and capital plans.

With vaccines closer to rollout and an end to the pandemic in sight, the ECB says public authorities face a delicate balance. They’ll shock the economy if they end pandemic support too suddenly, but undermine a necessary restructuring if they keep measures in place too long.

“There is a long road ahead,” Guindos said. “Government support schemes are essential currently but should remain targeted towards pandemic-related economic support and avoid giving rise to debt sustainability concerns in the medium term.”

Another immediate risk, the U.K.’s departure from the European Union’s single market on Dec. 31, is “mostly contained” after the European Commission allowed temporary access to critical derivatives clearinghouses in the U.K., the ECB said. The central bank also expects market participants in the EU to reduce their reliance on these firms, it said.

Longer-term, it said problems stemming from climate change shouldn’t be forgotten. Bank lending to carbon-intensive sectors -- a signal of exposure to such risks -- shows few signs of declining.

(Updates with banks stocks in fifth paragraph)

©2020 Bloomberg L.P.