Jun 15, 2019

ECB Will Act If Inflation Expectations Deteriorate, Guindos Says

, Bloomberg News

(Bloomberg) -- The European Central Bank’s vice president said policy makers will add stimulus if inflation expectations become deanchored, though they don’t believe a slump in a market measure of the price outlook signifies that’s the case yet.

“If you look at the survey of professional forecasters, the situation is a little bit different -- expectations have remained stable,” Luis De Guindos said in an interview with Italy’s Corriere della Sera. “Let’s see what happens. But I think the important part of our stance is that we are totally ready to react. We will have time enough to know the future when it arrives.”

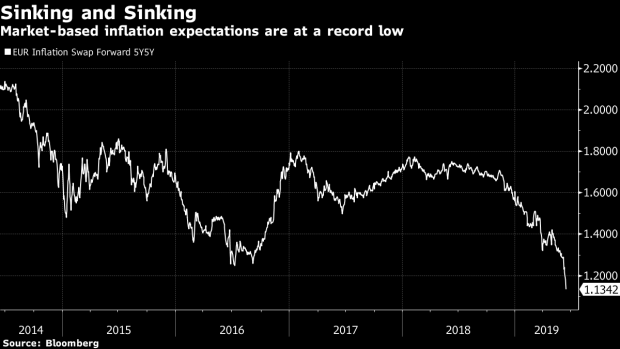

Investor expectations for future inflation tumbled to a record low this month even after the ECB extended its pledge to keep interest rates at record lows and said it has room to cut rates again or resume bond purchases. That’s a critical concern as it undermines the central bank’s credibility and weakens its ability to restore price stability.

In contrast, the ECB’s most-recent survey of inflation forecasters, published in April, showed a relatively mild downgrade in the outlook over the next couple of years. Analysts kept their long-term forecast for consumer-price growth at 1.8%. The ECB’s goal is just under 2%.

Guindos said the current monetary-policy stance -- a pledge to keep rates at current levels at least through the first half of 2020 -- is appropriate but “if there is a further deterioration, then we will react.”

He called on governments to use fiscal policy and structural reforms to bolster the economy. He also urged Italy, which has been in repeated disputes with the European Union over its spending plans, to agree clear objectives with its partners and drop any talk of parallel currencies such as so-called mini-BOTs.

“This idea of discussing mini-BOTs was a mistake,” he said. “The worst consequence of this kind of decision is that it destroys trust.”

To contact the reporter on this story: Paul Gordon in Frankfurt at pgordon6@bloomberg.net

To contact the editors responsible for this story: Paul Gordon at pgordon6@bloomberg.net, Steve Geimann

©2019 Bloomberg L.P.