Jun 1, 2023

ECB Won’t Consider Easing Before Core Inflation Slows, Rehn Says

, Bloomberg News

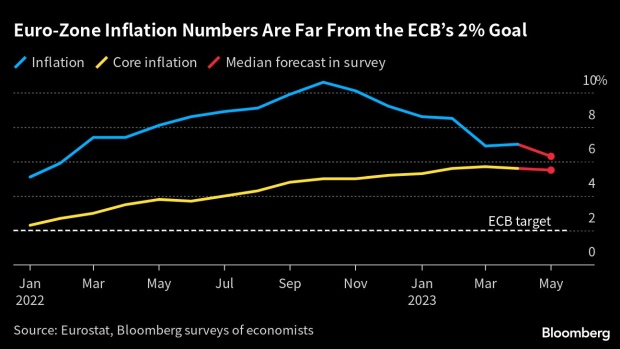

(Bloomberg) -- The European Central Bank won’t contemplate lowering borrowing costs before core consumer-price growth slows in a continuous manner, according to Governing Council member Olli Rehn.

“We have recently reached a point where rates are in restrictive territory,” the Finnish central bank chief said in a speech in Tokyo on Thursday. “In my view, it is essential that we see a steady and sustained decline in underlying inflation before we start considering easing the policy again.”

Consumer-price numbers later today are expected to show a drop in the headline gauge to 6.3%, while core inflation will probably hardly budge. The ECB’s current tightening cycle has seen 375 basis points of interest-rates increases since July, with two more 25 basis-point hikes expected this month and next.

“The journey is not over yet,” Rehn said.

©2023 Bloomberg L.P.