Mar 23, 2023

Economists Are Divided on Whether Turkey Will Pause or Surprise With Rate Cut

, Bloomberg News

(Bloomberg) -- Turkey’s central bank held off from cutting interest rates on Thursday as the lira comes under pressure and the economy absorbs the fallout of last month’s catastrophic earthquakes.

The Monetary Policy Committee led by Governor Sahap Kavcioglu left the one-week repo rate at 8.5%. The decision was in line with its guidance that the benchmark was at an “adequate” level following a half-a-percentage point decrease in February, a view the central bank reiterated in its statement on Thursday.

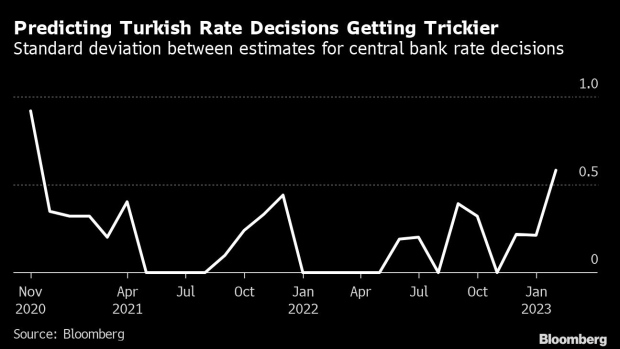

Economists in a Bloomberg survey were almost equally divided on whether policymakers would pause or cut. The central bank strayed from its guidance in the past, making it more difficult to forecast its next moves.

“The committee assessed that the current monetary policy stance is adequate to support the necessary recovery in the aftermath of the earthquake by maintaining price stability and financial stability,” it said in the statement. “The effects of the earthquake in the first half of 2023 will be closely monitored.”

With critical elections looming in May, the central bank has tilted dovish for much of this year even as price growth remains above an annual 55%. Guided by an unconventional belief that lower rates can bring down inflation, President Recep Tayyip Erdogan has been focused on boosting the economy with cheap loans ahead of the ballot.

The two earthquakes have complicated the calculus for the central bank. Record deficits in public finances and the current account mean it has to move carefully to support the economy with monetary stimulus.

The Treasury and Finance Ministry has said the quakes that killed over 50,000 people in the country will exact an economic toll estimated at about $104 billion.

What Bloomberg Economics Says...

“We maintain our position that the Turkish central bank looks likely to cut rates in April — the last meeting before the elections in May. We expect the bank to continue using alternative tools and currency market interventions to prop up the lira. The inaction on the policy rate will likely mean quite the opposite on alternative tools. The CBRT will likely continue to minimize the adverse impact of its loose stance on inflation and the lira through an increasing dependence on tools such as securities maintenance as well as regulation.”

— Selva Bahar Baziki, economist. Click here to read more.

Electoral Clock

The urgency is only increasing for Erdogan as his ruling alliance risks losing momentum against the opposition. In the latest attempt to fire up economic growth, Turkey’s sovereign wealth fund stepped up plans for a capital injection into state lenders.

But the efforts so far are yielding mixed results. With the lira under pressure, the central bank has made it difficult for firms to access cheap loans for fear they will use the funds to purchase foreign exchange.

And the cost of money is largely on the rise across the economy, with the weighted average rate for commercial loans surging this month to 16.2% for its biggest weekly increase in more than a year. The cost of consumer credit has been well over 20%.

Turkish Capital Boost in State Banks to Grow to $5.5 Billion

The upshot for markets is that the lira was probably already too exposed to bear another rate cut. Global policymakers also remain hawkish despite a sudden banking crisis, creating a risk for Turkey because its official borrowing costs are already among the world’s lowest when adjusted for inflation.

In its statement on Thursday, Turkey’s central bank acknowledged the turmoil that’s swept up global markets, saying “conditions threatening financial stability have emerged.”

Lira forward contracts are showing that traders expect a decline in the currency after the election, regardless of who wins.

Without recourse to higher rates, the central bank has tried to keep the currency stable in part through back-door interventions and measures that require exporters to surrender some of their foreign-exchange income.

Another reason for the central bank to hold off from monetary easing is that its reserves have additionally come under strain from having to finance the bulk of Turkey’s current-account deficit, which reached a record of almost $10 billion in January.

“The ongoing pressure on gross reserves since the start of the year amid a stable lira does not provide much space for accommodative financial conditions,” Morgan Stanley economists including Alina Slyusarchuk said in a report.

--With assistance from Joel Rinneby and Tugce Ozsoy.

(Updates with economist comments.)

©2023 Bloomberg L.P.