Mar 17, 2023

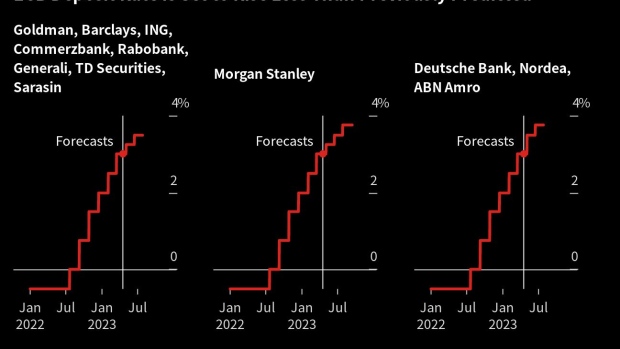

Economists No Longer Expect ECB Rates to Reach 4% After Turmoil

, Bloomberg News

(Bloomberg) -- Economists predict the European Central Bank will stop raising interest rates before they reach 4% — a scenario that was widely expected and priced in by investors until just a week ago.

The change in outlook comes after the collapse of Silicon Valley Bank in the US and troubles at Credit Suisse Group AG threw markets in a tailspin, raising the specter of a fresh financial crisis. The ECB on Thursday followed through on plans to raise borrowing costs by another 50 basis points though didn’t offer any guidance on the future policy path.

Banks including Goldman Sachs and Barclays now predict only two more quarter-point moves that would take the deposit rate to 3.5%. Morgan Stanley and ABN Amro are among those expecting a slightly higher terminal rate of 3.75%.

Here is a rundown of what banks now predict:

Goldman Sachs

“We believe that further rate hikes are likely despite the financial market volatility because (1) the risk of severe banking sector contagion still looks limited, (2) core inflation is likely to remain strong in coming months, and (3) President Lagarde stressed that the ECB has separate tools to deal with high inflation and financial stability concerns. That said, we now expect a 25 basis-point hike in May, vs. 50 basis points before, and 25 basis points in June, unchanged, for a terminal rate of 3.5%, vs. 3.75%”

Morgan Stanley

“Assuming a full resolution of current events and market turbulence receding, we would expect the ECB to continue hiking at upcoming meetings. However, in line with a more gradual approach from the ECB compared with our call before, we now expect the ECB to deliver a 25 basis-point rate hike in May, rather than 50 basis points as previously anticipated. We maintain our call that the ECB will continue tightening monetary policy in June and July at 25 basis-point increments at each meeting. We anticipate that it will stop its hiking cycle in September, when we think the ECB projections will show inflation converging to target well ahead of the end of its forecast horizon.”

Barclays

“The absence of forward guidance and the president’s communication during the press conference conveyed a sense of caution, given elevated uncertainty about the future. Granted inflation is very high, which requires further rate hikes, but developments in financial markets are so fluid that any commitment was regarded by the Governing Council as premature. As such, the future monetary policy stance is highly uncertain.”

Nordea

“We continue to think the ECB will deliver several further rate hikes in the upcoming meetings. Such expectations are naturally subject to recent banking worries not growing into larger and more-longer lasting turmoil and the development of especially the inflation data.”

ING

“With any further rate hike the risk that something breaks increases. Therefore, today’s decisions could mark the start of the final phase of the ECB’s tightening cycle: a slowdown in the pace, size and number of any further rate hikes.”

ABN Amro

“The risks are now skewed towards a lower peak for two reasons. We expect economic growth to turn out weaker than the ECB expects as the impact of monetary tightening dampens demand more strongly than in the central bank’s projections. However, there is uncertainty about how quickly that comes through convincingly in the macro data. Meanwhile, although we agree with the ECB that eurozone banking sector fundamentals are generally solid, there is a risk that financial market tensions continue to escalate to the extent that financial conditions tighten more sharply.”

Deutsche Bank

“Even if market conditions normalize quickly, this episode of financial and banking market stress highlights the risks of overtightening. As such, the hurdle on the data to justify slowing the pace of hikes is likely lower than we thought previously.”

Commerzbank

“The ECB has not let the market turbulence dissuade it from delivering the 50 basis points rate hike they announced in February. This investment in its credibility is necessary because inflation risks remain pronounced. In contrast to the market, we expect the ECB to raise its deposit rate further to 3.5% in the coming months.”

Rabobank

“President Lagarde made it clear that the inflation fight is not over. Nonetheless, markets are currently only reluctantly pricing higher policy rates again. This muted response was perhaps the best the ECB could hope for at this time. When calm returns to the markets, the Council can gradually fine-tune policy expectations. We maintain our call for two more 25bp hikes.”

Generali

“While acknowledging huge uncertainties related to banking stress and its impact on growth and inflation, we now expect the ECB to slow its pace of rate increases to two further 25 basis-point moves and hike to a 3.5% peak by June. The risks are tilted towards less tightening and mainly related to the strength and persistence of the financial market woes”

TD Securities

“The ECB is trying to draw clear lines between its inflation fight and its job of maintaining financial stability. This is a theme other central banks are likely to echo. It is rare that financial turmoil emerges in such a high-inflation environment, and while tighter financial conditions come at a convenient time for inflation-fighting central banks, they are unlikely to believe that tighter financial conditions alone will be enough to return inflation to target. Therefore, rates are still likely to head higher.”

Bank J Safra Sarasin

“The ECB left no doubt that fighting inflationary pressures is its main focus. Unfortunately, it cannot be said what the decision would have been without the ECB’s precommitment to hike 50bp this time. Theoretically, a smaller rate hike could have been sufficient given the tightening of financial conditions that occurred as a result of the current market turbulences.”

©2023 Bloomberg L.P.