Jul 21, 2022

Economists See China 2022 GDP Below 4% on Covid, Global Risks

, Bloomberg News

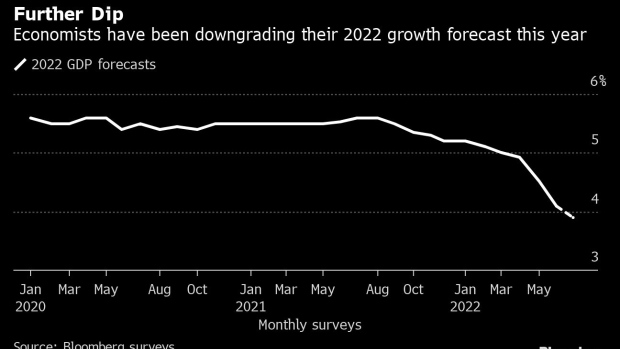

(Bloomberg) -- China’s economic growth will likely slip below 4% this year as the nation’s Covid Zero policy, a crisis in the property sector and a darkening global outlook continue to weigh on the country.

Gross domestic product is expected to increase 3.9% in 2022 from a year ago, according to the median estimate from the latest Bloomberg survey of economists. That’s down from the prior survey estimate of 4.1%, and well below Beijing’s official target of about 5.5%.

The growth estimate for the third quarter fell 30 basis points to 4.2%, according to the survey. The outlook for the last quarter remained unchanged at a projected 5% expansion.

“China is facing renewed headwinds from rising property stress, weakening US and Euro demand and uncertainty over new Covid restrictions taking a big toll on private consumption and small businesses,” said Allan von Mehren, economist at Danske Bank. He estimates full-year growth to reach just 2.7% this year. “The arrival of the more contagious omicron variant has added to the Covid challenges lately.”

Data released last week showed economic growth slowed sharply to 0.4% in the April-to-June period, fueling expectations that the official target won’t be reached. In a speech earlier this week, Chinese Premier Li Keqiang signaled flexibility on the growth target and said the most important thing was to keep employment and prices stable.

Other highlights from the survey:

- GDP outlook remain unchanged for 2023 and 2024 at 5.2% and 5%, respectively

- Forecasts for consumer prices and factory-gate prices this year were each raised by 0.1 percentage point

- Outlook for exports this quarter was raised by almost 2 percentage points to 7.9%, while import trade was cut to 5.4% from 6%

- Reserve requirement ratio for major banks is projected to be cut to 11% in the third quarter, down from 11.25% currently -- that’s the same projection as recorded the previous survey

- Other key policy rates, including the loan prime rates and medium-term lending facility rate, are expected to stay unchanged this quarter

©2022 Bloomberg L.P.