Oct 25, 2020

Egypt Debt Attracts More Foreigners as Holdings Double Since May

, Bloomberg News

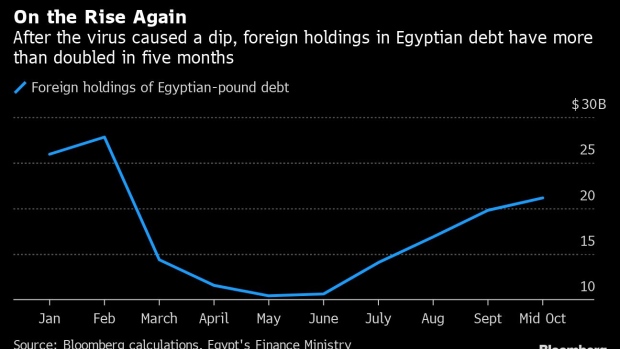

(Bloomberg) -- Foreign investors are returning in force to Egypt’s local debt after the coronavirus sparked a selloff, more than doubling their holdings in five months.

Encouraged by Egypt’s recent financing agreements with the International Monetary Fund and others, foreigners increased investments in Treasury bills and bonds to $21.1 billion in mid-October from $10.4 billion in May, according to Mohamed Hegazy, head of the Finance Ministry’s debt management unit.

While still below the $27.8 billion held in February, it’s a welcome supply of fresh funding for the North African country. Two of its main sources of foreign currency -- tourism and Suez Canal receipts -- have taken blows from the pandemic.

And although Egypt saw its biggest-ever capital outflows between March and May as part of a selloff that hit emerging markets across the globe, the reversal is being fueled by the world’s best carry-trade returns after Argentina.

“We saw a huge foreign appetite in local bonds starting from late August despite the global uncertainty,” Hegazy said in an interview.

When foreign investors withdrew earlier in 2020, they “experienced a quick and easy exit, unlike in some other markets,” which “enhanced their confidence in our economy,” the official said.

Read more: Set Back by Virus, Egypt Revives Debt Plans as Foreigners Return

Stable outlooks from the three main credit-rating companies after the pandemic hit as well as recent Eurobond and green bond issuances are feeding the foreign appetite, according to Hegazy. Foreigners now account for 9.4% of total local-debt holdings, up from 5.2% at the end of June.

A shift into longer-maturity debt is also helping one of the Middle East’s most indebted countries ease its borrowing costs. Net issuances of bonds rather than shorter-term bills accounted for 71% of Egypt’s total net local issuances by the end of September, compared with 20% three months earlier.

Reflecting that, average maturities of Egypt debt were 3.2 years at the end of June, up from 1.3 years in the same period of 2013, according to Hegazy.

“Foreign appetite in local bonds has recently helped the country reverse what was an inverted yield curve in the last two years,” he said.

The shift could give a boost to Egypt’s initiative to have its bonds listed in a JPMorgan Chase & Co.’s emerging-market indexes that are a benchmark for investors. Combined with a drive to make the country’s debt Euroclearable, that could spur further interest.

©2020 Bloomberg L.P.