Mar 31, 2023

Egypt Jumbo Hike Too Small to Beat Inflation, Bond Buyers Say

, Bloomberg News

(Bloomberg) -- Egypt’s 200 basis-point interest rate hike has not satisfied bond investors who say the central bank must do more if it is to vanquish inflation and revive flagging financial market flows.

The jumbo rate rise was delivered late Thursday, after authorities disappointed investors in February by holding borrowing costs unchanged. However, the increase is smaller than the 300-basis-point hike that firms including Goldman Sachs Group Inc. and Abu Dhabi Commercial Bank were forecasting.

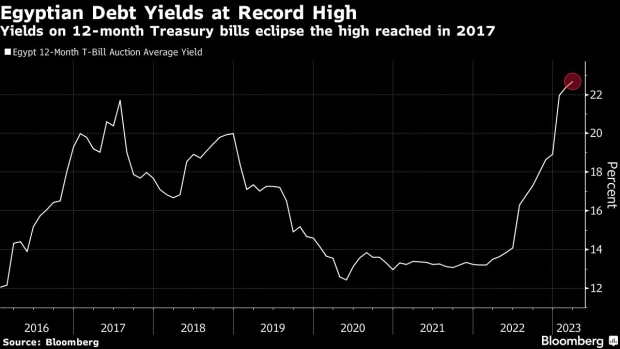

Derivatives traders are hedging against the prospect of a steeper decline in the pound, threatening to exacerbate inflation which climbed to 31.9% in February, several times the targeted rate. Yields on pound-denominated government bonds have also raced higher, and at Thursday’s 12-month T-bill auction, Egypt raised about 3.5 billion pounds ($115 million) at a record high 22.683% yield.

“We are still confident Egypt will get to the appropriate policy mix, but we are not there yet,” said Mohieddine Kronfol, the Dubai-based chief investment officer for Middle Eastern and North African fixed income at Franklin Templeton. “I am not confident that (investment) flows will necessarily follow.”

Investors are also urging Egypt to implement more currency flexibility. The government had pledged in October to move to a more flexible exchange rate, enabling it to clinch a $3 billion deal with the International Monetary Fund. But long stretches of stability have followed bursts of volatility and steep downswings.

The pound rose 0.3% to 30.80 against the dollar as of 8:10 a.m. in New York. But its value on the local black market has diverged further from the official bank rate, amid speculation the cash-strapped country might enact its fourth devaluation since March 2022.

“Flows into Egypt are arguably linked to the pound being freely floating,” said Franklin Templeton’s Kronfol. “Anyone that looks at the Egyptian pound chart can see it is not.”

While Egypt needs foreign capital, monetary authorities are walking a tight line, as they balance tightening policy to tame inflation against the risk of economic recession and unrest in the nation of 109 million.

One of the world’s largest wheat importers, Egypt was hit hard by the economic fallout from Russia’s invasion of Ukraine in February last year. Before that, its pegged currency and the world’s highest inflation-adjusted interest rates had made it a prime destination for volatile hot-money. There are signs such flows are no longer welcome.

READ MORE: Egypt’s Maait Says It’s Time to Rethink Carry-Trade Reliance

“They can ill afford to take too much of a hit to growth and risk rising societal unrest in Africa’s most populous country,” said Todd Schubert, Dubai-based head of fixed-income research at Bank of Singapore.

Still, the central bank is expected to raise interest rates by at least another 200 basis points, with a “significant increase” in borrowing costs likely during the next round of currency devaluation, said Monica Malik, chief economist at Abu Dhabi Commercial Bank. Egypt’s “real” or inflation-adjusted interest rate is currently around minus 13.7% — one of the lowest among more than 50 major economies tracked by Bloomberg.

“The hike is too small to catalyze significant capital inflows, and thus is unlikely to ease pressure on the pound or alleviate the FX scarcity issues the economy is facing,” Farouk Soussa, an economist at Goldman Sachs Group Inc., said in a note, urging the government to accelerate reforms, including asset sales and currency flexibility.

Underscoring investors’ anxiety, the cost of protection against a possible default on Egyptian debt rose 25 basis points to 1,343 basis points, according to CMAQ data. But Friday’s risk-on mood on global markets lifted the country’s sovereign dollar bonds, with yields on securities due 2051 falling 15 basis points.

©2023 Bloomberg L.P.