Mar 30, 2023

Egypt Makes Jumbo Rate Hike to Tackle Prices Hit by Devaluations

, Bloomberg News

(Bloomberg) -- Egypt resumed a cycle of monetary tightening as the central bank tries to tackle inflation that’s been stoked by currency devaluations.

The Monetary Policy Committee raised the deposit rate by 200 basis points to 18.25% and the lending rate to 19.25%, it said in a statement Thursday. All but one of 11 economists surveyed by Bloomberg had predicted an increase although they were split on the magnitude.

The jumbo hike in borrowing costs comes as Egyptian food prices hit a record, further squeezing consumers in the North African country of more than 104 million people, where almost half live below or near the poverty line. Overall inflation is at its highest since August 2017.

Read: How to Know Where Egypt’s Once-in-Decade Crisis Is Heading

The central bank surprised by leaving rates on hold last month, saying it was assessing the impact of a combined 800 basis points of increases in 2022. It targets inflation of 7%, plus or minus 2 percentage points, by the fourth quarter of next year.

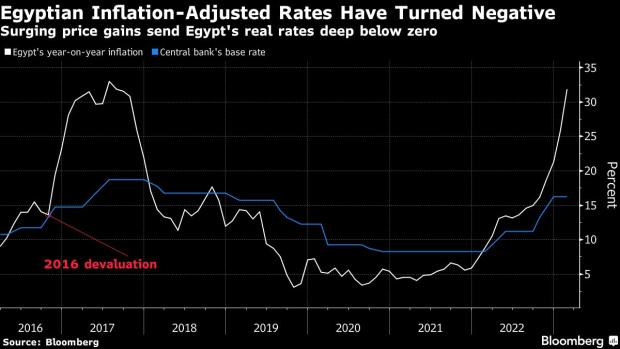

Inflation accelerated faster than expected in February to an annual 31.9%. The figure reflects three devaluations of the pound after Russia’s invasion of Ukraine tipped Egypt, a major food importer, into economic crisis and caused a foreign-exchange crunch.

Egypt has reached a $3 billion agreement with the International Monetary Fund and secured $13 billion of deposits from its energy-rich Gulf allies, including Saudi Arabia and Qatar, to try and mitigate the impact.

Read: Gulf Powers Play Hardball Over Sending Billions to Rescue Egypt

Raising rates, however, may only be a stopgap solution. Pressure is building again on the pound as Egypt races to find foreign investment to tackle its external funding gap, including through an ambitious plan of company stake sales.

The latest hike may help a return of portfolio investment after Egypt’s official borrowing costs turned deeply negative when adjusted for inflation. A real interest rate that was once the world’s highest is now far below zero, at almost minus 16% — one of the lowest among more than 50 major economies tracked by Bloomberg.

That’s combined with a 20% weakening of the pound against the US dollar this year, denting demand for the nation’s debt. Yields on the nation’s 12-month Treasury bills rose to a record high this month.

Goldman Sachs Group Inc. expects inflation to peak in the third quarter at around 36%, barring any further devaluations.

--With assistance from Abdel Latif Wahba.

©2023 Bloomberg L.P.