Aug 5, 2021

Egypt to Hold Interest Rate as Prices Climb

, Bloomberg News

(Bloomberg) -- Egypt will likely extend this year’s pause in monetary easing on Thursday as the surge in global prices looks set to trickle through to inflation and authorities seek to maintain foreign appetite for local debt.

Recent weeks have seen costs in the North African nation raised for fuel, electricity and tobacco products, steps that partly reflect the worldwide spike in commodities and may spur quickening in inflation. All 11 economists surveyed by Bloomberg predict the central bank’s Monetary Policy Committee will hold its benchmark deposit rate at 8.25% for a sixth consecutive meeting, after cutting a combined 400 basis points in 2020.

“The rise in global inflation is starting to hit home,” said Mohamed Abu Basha, head of macroeconomic research at EFG Hermes. “Producers are also gradually reflecting their rising input costs on products, although that’s happening at a slow pace. This will leave the central bank keeping a close eye on inflation.”

President Abdel-Fattah El-Sisi on Tuesday called for a rise in prices of subsidized bread, a move the government is studying although there have been no official figures yet on what the new cost would be.

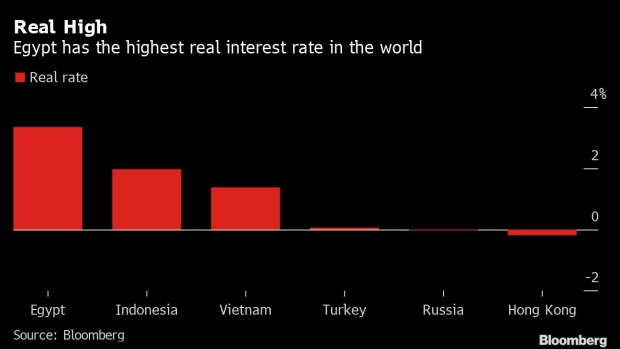

The other key consideration will be keeping a wide differential between Egypt’s inflation and policy rates, currently the broadest of more than 50 economies tracked by Bloomberg. That ranking has helped raise foreign holdings in Egyptian debt to more than $28 billion, important funding while the tourism industry awaits full recovery from the coronavirus pandemic.

Local-currency bonds have returned about 7% this year, the biggest gainer in emerging markets after Argentina and South Africa, according to Bloomberg Barclays indexes.

Any uptick in Egyptian inflation is expected to be both limited and short-lived, remaining within the central bank’s target range of 5%-9%. Consumer prices in urban parts of Egypt accelerated to an annual 4.9% in June, from 4.8% the previous month.

After an expected rise in July, price growth will probably remain well below the mid-point of the target into next year, “contained by muted demand-side pressures and continued currency strength,” HSBC Holdings Plc said in a note.

While emerging-market peers such as Russia, Brazil and Ukraine are tightening policy, “we see no need for Egypt to follow suit,” said Simon Williams, HSBC’s chief economist for Central & Eastern Europe, the Middle East and Africa.

“A surprise cut remains a more pronounced risk than a hike” for both Thursday’s meeting and the rest of the year, he said.

©2021 Bloomberg L.P.