Jan 31, 2023

Electronic Arts Falls on Weak Forecast, Star Wars Game Delay

, Bloomberg News

(Bloomberg) -- Electronic Arts Inc. shares slumped after the video game maker gave a disappointing outlook for the current quarter due to a six-week delay in the release of its next highly anticipated Star Wars game.

The company expects net bookings, which exclude deferred sales from online purchases, of $1.68 billion to $1.78 billion in the three months ending in March. Analysts had projected $2.22 billion, according to data compiled by Bloomberg. The shares slid about 10% in extended trading.

EA is pushing the launch of the next installment of one of its biggest franchises, Star Wars Jedi: Survivor, to April 28 from March 17, to hit the “quality bar, provide the team the time they need, and achieve the level of polish our fans deserve,” the company said in a statement. EA will also cease development on mobile offerings for its popular Apex Legends and Battlefield franchises. Shifting the launch of the Star Wars game to the next fiscal year also prompted EA to lower its outlook for bookings for fiscal 2023.

As a result of ending development of the mobile version of Battlefield, the company will shutter its Pasadena, California, mobile game studio Industrial Toys, which worked on the game. Halo co-creator Alex Seropian was a co-founder of the studio, which started in 2012 and was acquired by Electronic Arts in 2018.

“As the industry has evolved and our strategy to create a deeply connected Battlefield ecosystem has taken shape, we decided to pivot from the current direction to best deliver on our vision for the franchise and to meet the expectations of our players,” an EA spokesperson said in an email.

More than 60 workers may be affected by the studio closing, said two people familiar with the issue. The EA spokesperson said the company’s goal is to offer some Industrial Toys’ employees work on other projects, but declined to specify the number of jobs being cut.

Last year was sluggish for the games industry due to a slow rate of new releases and the beginnings of an economic downturn. Covid-related game delays pushed several anticipated titles into 2023, including Electronic Arts’ remake of 2008 survival-horror game Dead Space. Overall spending on video game content declined 4.3% in 2022 to $184.4 billion, according to estimates from gaming analytics firm NewZoo. Several video game publishers have signaled that sales over the holiday period were weak, including Microsoft Corp., where revenue from its gaming unit fell 13% in the three months ending Dec. 31.

“As market uncertainty mounted during the quarter, we took measures to protect underlying profitability,” Chief Financial Officer Chris Suh said in the statement. “We are prioritizing the player experience, directing investment to where it can have the most positive impact for our players and on growth.”

Known for its sports and Star Wars games, Electronic Arts released few major titles in the second half of 2022 outside of yearly entries to its FIFA, NHL and Madden NFL series. The racing game Need for Speed Unbound, which launched in December, received little attention.

Redwood City, California-based Electronic Arts also faced stiff competition for gamers’ attention in the quarter, with big holiday releases from Activision Blizzard Inc.’s Call of Duty: Modern Warfare II to Sony Interactive Entertainment’s God of War Ragnarök, according to Nick McKay, an analyst at Wedbush Securities.

EA said that despite Apex Mobile’s strong start, “the ongoing experience was not going to meet the expectations of our players.” Apex Legends Mobile, a spinoff of EA’s popular battle royale shooter, will shut down on May 1, developer Respawn Entertainment said on Twitter. EA said it will stop further development of the current Battlefield mobile title too, though said it’s “hard at work at evolving Battlefield 2042, and are in pre-production on our future Battlefield experiences at our studios across the globe.”

In the third quarter, net bookings fell 9%, to $2.34 billion, the biggest year-over-year decline in two years. EA reported adjusted earnings per share of $2.80, compared with projections of $3.05. In the current period, EA expects adjusted earnings per share of $1.20 to $1.40, compared with the Wall Street estimate of $2.21.

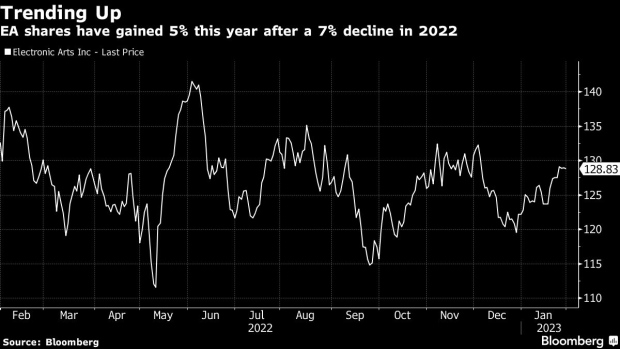

The stock dropped almost 11% in extended trading after closing at $128.68 in New York. The shares have declined 3% in the past 12 months, in line with a similar decline at Activision, but better than the nearly 30% drop at Take-Two Interactive Software Inc.

Many analysts expect this year to be better for the games industry and EA is already signaling a potential turnaround. Its Dead Space was the top-selling physical release in the UK in the week ending Jan. 28, according to GamesIndustry.biz.

(Updates with studio closing beginning in the fourth paragraph.)

©2023 Bloomberg L.P.