May 13, 2021

Elon Musk Just Helped Ease the Semiconductor Shortage

, Bloomberg News

(Bloomberg) -- When Elon Musk said that Tesla would no longer be accepting Bitcoin for payment, ostensibly for environmental reasons, he didn’t just cause the price of Bitcoin to tumble. Basically the entire cryptocurrency market went into a rapid nosedive. Of course, the market is always volatile. And there’s a high degree of correlation among coins, but still the reaction across the space was swift and clear.

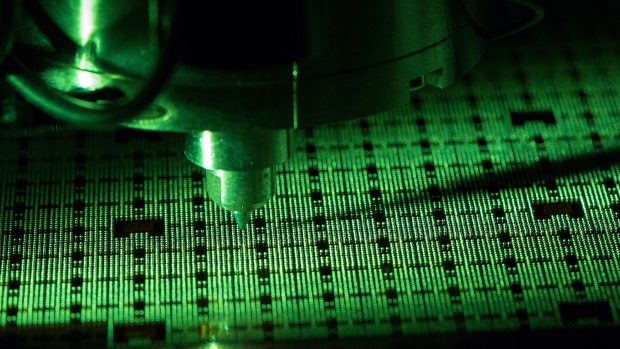

On Odd Lots we’ve been talking a lot about the semiconductor shortage, but one topic we’ve yet to cover is the intersection of semiconductors and cryptocurrency mining. However it’s becoming pretty clear that you can’t fully separate the two stories. Bitcoin uses specific chips for mining, which are only used for mining Bitcoin. However others, like Ethereum, can be mined with chips that might otherwise be used as graphics cards. In fact, this is a huge source of angst in the gamer community: People are frustrated that they can’t easily get graphics chips from companies like Nvidia due to demand from crypto miners.

And there’s more. According to some reports, the price of hard drives has soared in China, because they’re used to mine the new cryptocurrency called Chia, which already has a fully diluted market cap of over $20 billion according to OnChainFX.

Of course, a one-day price move isn’t going to move the needle that much. But the surge in coins over the last year has definitely lead to a boom in demand for mining them, which is definitely a part of the semiconductor story and at the margin makes the market tighter. A downcycle would free up some marginal capacity. Thanks Elon!

©2021 Bloomberg L.P.