Dec 15, 2022

Elon Musk’s Tesla Share Sales Could Point to Debt Help for Twitter

, Bloomberg News

(Bloomberg) -- As he was offloading almost $3.6 billion of Tesla Inc. shares this week, Elon Musk took to Twitter, his newest business, to offer some financial advice.

“At risk of stating obvious, beware of debt in turbulent macroeconomic conditions, especially when Fed keeps raising rates,” he wrote on Tuesday, the day before the US central bank boosted its policy rate by another 50 basis points.

Among those who have reason to be concerned about such things: Musk himself.

His Twitter Inc. buyout piled about $13 billion of high-interest debt onto the social media platform. The riskiest portion, with a painful fixed coupon of around 11.75%, is a $3 billion bond - notably an amount that could be covered by his recent Tesla stock sale.

There are various reasons why Musk might find buying the debt appealing. It would save Twitter about $350 million in annual interest payments, according to Bloomberg calculations. What’s more, Musk would likely be able to buy the bonds at a steep discount, further lowering the company’s debt burden. Owning the obligations could even potentially put Musk in a better position if Twitter’s financial situation became more dire — he notoriously raised the specter of bankruptcy to employees last month.

“To the extent that Musk could buy back the debt at a significant discount to par, that seems like a plausible scenario,” said Jordan Chalfin, a senior analyst at credit research firm CreditSights. Banks have presumably marked down the value of the debt and likely want to reduce their exposure, Chalfin added.

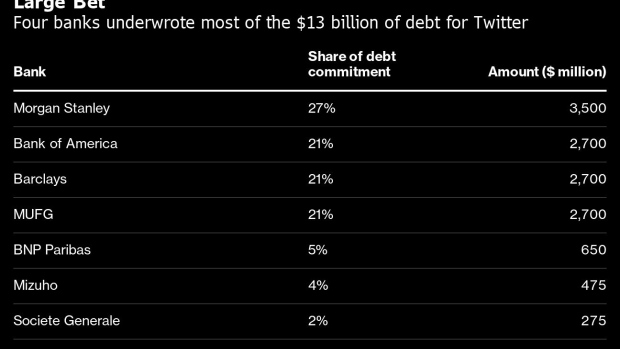

Representatives for Morgan Stanley, which led the debt transaction, Twitter, and Musk didn’t immediately respond to requests seeking comment.

Of course, how Musk and his bankers proceed remains an open question. But both have every reason to see Twitter succeed. Musk wants to protect his equity investment, which along with a handful of other backers, totals $33.5 billion. The banks want to protect the value of the $13 billion they lent the company and currently hold on their balance sheets. But both also have much to lose in any negotiations.

Should Musk try to buy the debt from the banks, he would almost certainly only want to do so at a steep discount, a tactic common in distressed debt situations.

That would likely result in significant losses for the banks, and makes the decision to offload it more complicated.

The debt financing includes a $6.5 billion floating-rate secured leveraged loan, and $6 billion of bonds, split equally between a secured and unsecured tranche. The secured portions are considered safer because they are backed by the assets of Twitter, and therefore have lower interest rates.

In November, hedge funds and other asset managers offered to buy a portion of the senior secured loan at a discounted price as low as 60 cents on the dollar — meaning banks would lose 40% on any debt they sold — but the banks deemed those bids unattractive at the time, Bloomberg reported. Any discount on the unsecured bonds would need to be even lower still.

If Musk and the banks did come to some kind of an agreement, he would also have to decide how to buy the debt. If the billionaire bought it himself, then technically Twitter would still have to pay interest to him. Alternatively, Musk could inject more cash into Twitter, and the company would buy back its own debt directly, essentially canceling the interest expense in the process.

More Control

Owning the debt would afford Musk more leeway in a worst-case scenario in which Twitter declared bankruptcy — the prospect of which he’s already raised with employees.

The type and amount of his debt holdings would determine his position in a restructuring. Owners of senior secured debt typically hold more sway than unsecured bondholders, and all debtholders are in a better negotiating position than equity holders, who are usually wiped out in the Chapter 11 process. As it currently stands, the banks would presumably become the new owners if a bankruptcy were to happen.

More Cash

Twitter’s banks have already been weighing replacing some of the riskiest bonds with new margin loans backed by Tesla stock, one of several options being discussed to soften the company’s interest burden, Bloomberg reported last week.

Musk could also consider an equity infusion to support Twitter’s operations. The company is currently burning cash, and he has noted that the social-media platform has experienced a significant drop in revenue amid advertiser defections.

“I think he’s sold enough Tesla stock already to cover operating losses,” said Gene Munster, managing partner of Loup Ventures.

Of course, a cash injection would be among the riskiest tactics. While it could give Twitter the breathing room it needs, it may also mean Musk is just throwing good money after bad.

--With assistance from Brian Chappatta, Dana Hull and Eliza Ronalds-Hannon.

©2022 Bloomberg L.P.