Aug 2, 2020

Emerging-Market Rebound Hangs in Balance as Economies Struggle

, Bloomberg News

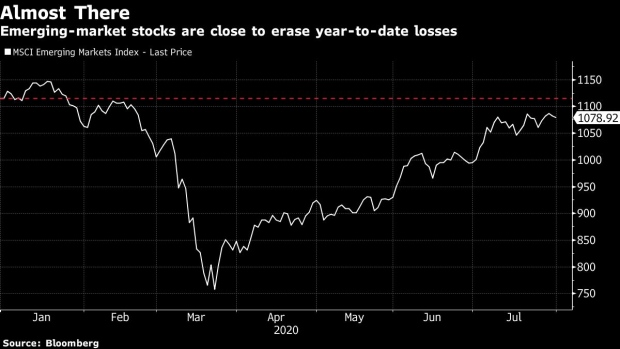

(Bloomberg) -- Emerging-market stocks and currencies are within touching distance of erasing their pandemic-fueled losses of 2020. Too bad the virus is still running riot, economies are shrinking and central banks are getting low on firepower.

In fact, the backdrop is so grim that investors may soon start to take the view that prices are starting to defy gravity. After falling more than 30% by March, developing-nation stocks as measured by MSCI Inc.’s benchmark index are just 3% below the level at which they started the year. A gauge of currencies is also 3% short of its 2020 starting point, while a Bloomberg-Barclays index of local bonds is already back in positive territory.

The reality is that currencies have been underpinned by the slide in the U.S. dollar, stocks are riding the global stimulus wave and bonds are enjoying the boost provided by more than 5,500 basis points of interest-rate cuts across emerging markets since the start of 2019.

Which makes the start of August -- typically one of the riskiest months of the year for the asset class -- a cause for nervousness.

“Given the pandemic shows no signs of subsiding, a weak economic tone will almost certainly be carried over to August,” Prakash Sakpal, an economist at ING Groep NV in Singapore, wrote in a report. “Unfortunately, central bank monetary easing to support growth has also reached its limits.”

Activity data due in coming days may help investors gauge where the developing world is headed next, as many countries seek to recover from periods of government-imposed social isolation. While PMIs from Asia, the region first affected by the Covid-19 pandemic, are expected to improve, activity data in Chile may underscore the severity of the virus in Latin America, the current hotspot for the disease.

Brazil’s central bank is expected to cut rates by a quarter-percentage point this week, taking borrowing costs to a record low of 2% in a bid to support an economy devastated by the second-highest number of Covid-19 cases. Bets on more easing are less certain in India, where policy makers are weighing the necessity of further stimulus against the risk of a rising inflation rate.

Central Bank Meetings

- Brazilian policy makers are expected to reduce the key rate on Wednesday to an all-time low of 2%, according to the median of economist forecasts compiled by Bloomberg. Industrial production figures on Tuesday may provide insight into how the virus is affecting South America’s biggest economy

- The Bank of Thailand is likely to leave rates on hold on Wednesday, the penultimate meeting for the outgoing governor. Analysts may be looking for subtle changes of policy tone because, although the incoming Sethaput Suthiwart-Narueput only takes over on Oct. 1, he is an existing monetary policy board member, potentially giving him more voice at this week’s meeting. The Thai baht has perked up in the past week, but is a long way from making up the ground lost since the end of June as idiosyncratic flows, benign neglect from the central bank, and disappointing tourism numbers undercut the currency

- The Reserve Bank of India’s meeting on Thursday hangs in the balance. While the RBI has plenty of space for rate cuts and has flagged a willingness to continue to loosen, it may be concerned that inflation has been persistently high. Indian bonds have remained in a holding pattern in the third quarter, in contrast with the rally seen in Indonesia

- Colombia’s central bank will release meeting minutes on Monday, which will offer insight into the July policy decision, when officials cut rates for a fifth straight meeting. Consumer-price figures for July, to be released on Wednesday, may show a fourth monthly decline

Debt Restructurings

- The self-imposed deadline for Argentina to wrap up debt talks on a $65 billion bond-restructuring deal expires Tuesday, though the government hasn’t ruled out another delay. While investors are split on whether to accept the nation’s latest offer, Bloomberg Economics sees the most recent government proposal as very close to the nation’s limit

- Ecuador pushed its own deadline for creditors to accept terms of a bond-restructuring offer to Monday, and the results will be announced on Wednesday, with a high probability of sufficient approval, according to the finance ministry. The postponement came after GMO and Contrarian Capital Management sued to block the debt restructuring -- which offers investors 91 cents on the dollar -- calling it “coercive in the extreme”

Data and Events

- Asia’s July PMIs to be released on Monday are likely to show further improvement, while China’s Caixin services data are likely to be fairly stable in Wednesday’s reading

- China’s July trade data may add to optimism about further recovery in the world’s second-largest economy. However, the yuan’s appreciation has stalled, partly as the temperature has risen between the U.S. and China

- Several Asian nations release inflation data. Indonesia’s headline inflation to be released on Monday should dip further below the central bank’s target and on Tuesday Korean CPI may rise above zero for the first time since April. On Wednesday, Thai CPI is expected to remain negative in a year-on-year terms and in Taiwan base effects could drive the reading close to the zero line versus a year ago in data due on Thursday

- Philippines will release a slew of economic data. From Monday onwards, the May remittances number may be released, which consensus expects to contract 15%. On Wednesday, June trade numbers and July inflation rate are due and on Thursday second-quarter GDP data may show a further plunge in activity

- Indonesia will release second-quarter GDP data on Wednesday, and economists expect a sharp contraction. Indonesian bonds continued to rally last week following another strong auction, and despite news of higher future budget deficits

- South Korea’s current-account numbers are due on Thursday

- On Friday, investors will monitor Mexico’s July inflation figures for clues on how the virus and measures to offset its economic drag are impacting consumer prices

- A reading of Chile’s economic activity gauge for June, scheduled for Monday, will probably flag a contraction as much of the nation remained in a state of lockdown

- South Africa’s manufacturing PMI, due Monday, probably remained above the 50 level that signifies expansion in July, as the economy rebounds from the Covid-19 hit; PMIs in Poland, Hungary and Russia may also have climbed above the 50 level after sinking to record lows in May

- Russia’s consumer-inflation rate probably increased to 3.4% in the year through July, from 3.2% the previous month, data may show Wednesday, according to the median estimate in a Bloomberg survey

- Turkey’s inflation rate probably moderated in July to 12.1% from 12.6%, a report may show Tuesday

©2020 Bloomberg L.P.