Dec 22, 2021

Energy beats broader market for first time in five years

, Bloomberg News

Oil prices could spike if demand rebounds quickly from Omicron: Energy analyst

Divesting from oil and gas has been a profitable trade for the last couple of years. Now, for the first time since 2016, investors who held on to energy shares are poised to outperform the broader market.

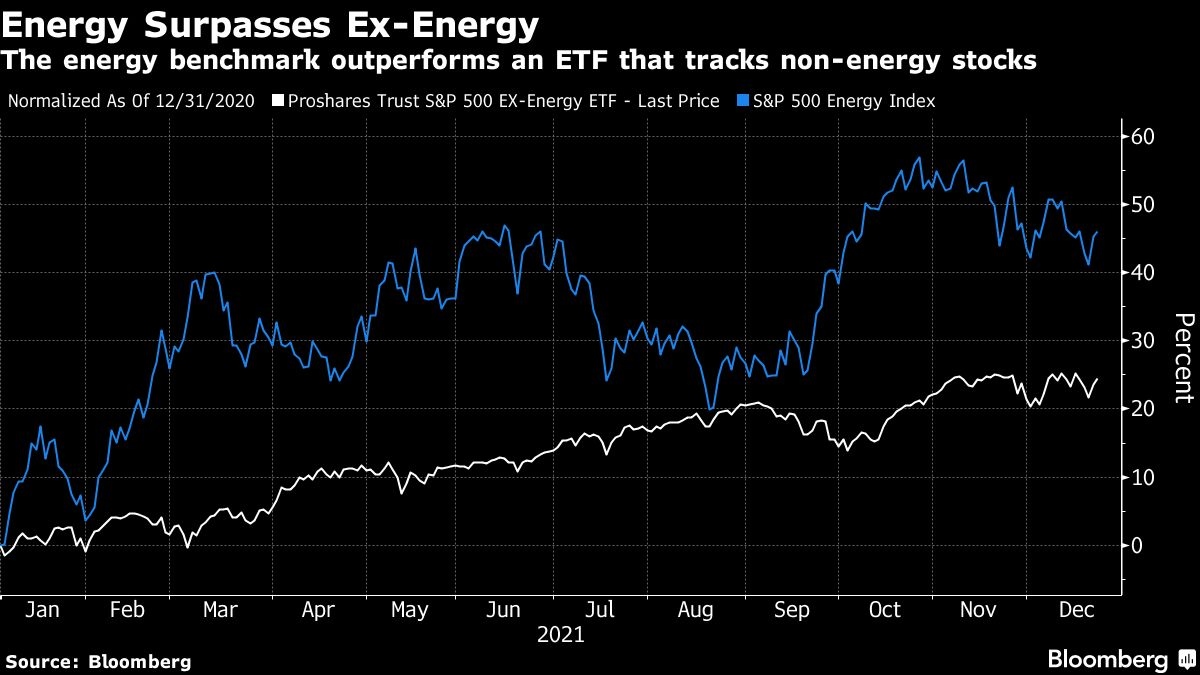

Oil and gas stocks have been the top market performers across North America even as the world ramps up efforts to curb its reliance on fossil fuels. In New York, the S&P 500 Energy Index has outperformed the broader S&P 500 by 21 percentage points so far this year, with the top performing stock, Devon Energy Corp., gaining a whopping 167 per cent.

In comparison, the S&P 500 Ex-Energy Index, which measures the broader U.S. market without oil and gas companies, underperformed the S&P 500 Energy Index by 22 percentage points. ProShares launched an ETF in 2015 to emulate the ex-energy index.

All of that is somewhat of a vindication for dedicated energy funds, which bet on energy companies’ ability to offset changing investor preferences by rewarding shareholders with dividend hikes and aggressive share buyback programs as commodity prices rose.

And it’s not over, some say.

“There’s a massive appetite to invest in it because it’s just spewing out cash right now,” said Rafi Tahmazian, partner and senior portfolio manager with Canoe Financial in Calgary. Tahmazian’s energy producer-focused fund is up 91.2 per cent year to date as of the end of November.

The futures curve for WTI shows traders expect oil prices will correct to the US$66-per-barrel range mid-year 2022 and US$65 per barrel at the end of the year. Still, Tahmazian said energy companies have paid down debt this year to the point they can continue to be profitable with lower crude pricing.

WIDER GAP

In Canada, where energy is a larger part of the country’s S&P/TSX Composite Index, with a more than 10 per cent weighting versus 2.7 per cent on the S&P 500, the divergence between the performance of energy funds and ex-energy funds relative to the benchmark is even greater.

The S&P/TSX Capped Energy Index has returned about 77 per cent so far this year, compared to 21 per cent for the S&P/TSX Composite Index.

Foyston, Gordon & Payne Inc. launched its own ex-energy equity fund in May 2021 as oil and gas prices were breaking out. At the time, the Toronto-based investment manager marketed the fund as having a carbon intensity 40 per cent lower than its benchmark. The fund’s performance was 35 per cent lower than the energy companies it excluded from its weighting.

FGP declined a request for comment on its ex-energy fund’s performance this year.

“Not owning energy has been an easy thing to do,” said Les Stelmach, senior vice-president and portfolio manager at Franklin Bissett Investment Management, a unit of Franklin Templeton. “For five of the last seven years, you can point and say you’ve made the right decision, but now you’re confronted with sharply higher commodity prices.”

“I do think there’s some vindication,” said Stelmach, whose dividend-focused fund is overweight energy and is up 16 per cent this year.