Feb 22, 2022

Energy Supply Is ‘Clearly’ Germany’s Top Risk in Russia Conflict

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The continued flow of natural gas is the key concern for Germany’s economy as tensions with Russia over Ukraine intensify.

The vulnerability “is clearly energy supply, but even there, the winter is almost over and other supply routes, other sources of supply have been discussed at least and have been prepared,” Ifo President Clemens Fuest said Tuesday in a Bloomberg Television interview with Tom Mackenzie.

“The German economy will be affected by rising energy prices but probably not much more than everyone else,” he said.

The European Union gets more than a third of its gas from Russia -- deliveries that could be at risk if Brussels follows through with threats to sanction President Vladimir Putin’s government or if transit pipelines in Ukraine are damaged in any military action.

Nord Stream 2, a newly built Russian gas link direct to Germany, can’t be certified right now, Chancellor Olaf Scholz said Tuesday.

Researchers at the European Central Bank reckon a 10% cut in gas supplies would reduce gross value added in the euro area by about 0.7%, with Austria and Slovakia among those countries most exposed.

European natural gas prices surged on Tuesday while oil approached $100 a barrel.

Beyond energy, the risks aren’t as high. Direct trade between Russia and Germany, for instance, has been subdued following penalties imposed in the wake of Russia’s 2014 annexation of Crimea, according to Fuest.

With Russia’s economy comparable in size to Spain’s, the volume is “not so significant,” he said.

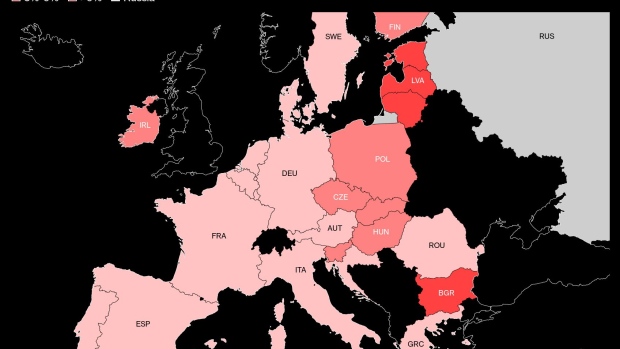

About 0.8% of the European Union’s economic activity is directly linked to Russian imports of intermediate and final products, according to Bloomberg Economics. The continent’s eastern contingent would be most-affected by sanctions against Moscow.

©2022 Bloomberg L.P.